The Report of the Board of Directors

The Board of Directors present their report and audited financial statements for the year ended 31 March 2023.

Governance

settle Group

settle Group (settle) is a registered Co-operative and Community Benefit Society with charitable objectives. The Group is registered with the Regulator of Social Housing and governed by a non-executive Board. It operates across Hertfordshire, Bedfordshire, Buckinghamshire and South Cambridgeshire, with its head office at Blackhorse Road, Letchworth Garden City, Hertfordshire, SG6 1HA.

The Group’s principal activities are the management and development of affordable and supported housing.

Rowan Homes (NHH) Limited

Rowan Homes (NHH) Ltd is a fully owned subsidiary of settle. Its purpose is to develop new housing properties for outright sale; this is not a charitable activity, and all profits are distributed to settle.

Board Structure and Membership

The Board comprises up to eight independent non-executive members and one executive Board member, the Chief Executive. The Board members are listed at page 4 and biographies are published on our website. Non-executive directors are recruited on a skills-based approach, and they have the appropriate range of skills, experience and competencies to provide strategic direction and oversee settles performance.

Each Board member (except the Chief Executive) holds one fully paid £1 share in the Group.

One Board member, the Chair of settle’s Development and Asset Committee retired at the end of the financial year, with one new member recruited to provide development skills to the settle Board, with membership commencing 1 April 2023. This supplements existing Board members’ sector experience and skillsets in housing management, banking, finance/investment finance, development, legal, governance, digital and customer service. Alongside our skill requirements recruitment continues to consider the Board’s diversity (including ethnicity, gender, age, disability and socio-economic background).

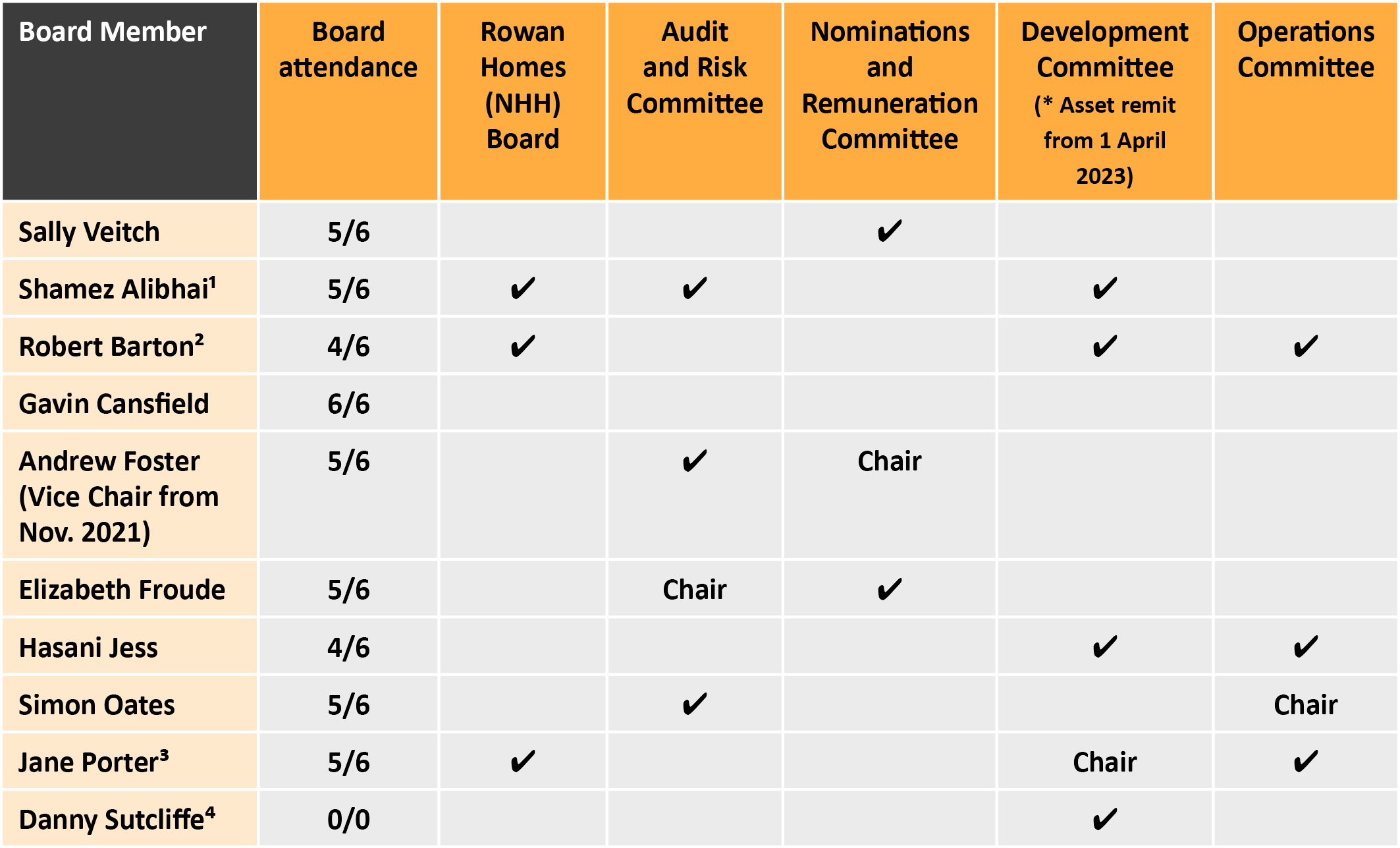

Board membership – details as at signing date, and meeting attendance for the year (out of a total of six meetings):

1 Appointed as a Director of Rowan Homes (NHH) Ltd Board on 22 June 2022

2 Retired as Board Member and Director of Rowan Homes (NHH) Ltd Board on 31 March 2023

3 Appointed by the Group as a Director of Rowan Homes (NHH) Ltd Board with effect from 1 April 2023

4 Appointment to settle Board commenced 1 April 2023

Executive Team

The Executive Team during the financial year ended 31 March 2022 are listed on Key Information.

The Executive Directors hold no interest in the Group’s share capital and, although they do not have the legal status of directors, they act as executives by the authority delegated by the Board. The Executive officers are responsible for the day-to-day management leadership of settle.

Corporate Governance Statement

Overview

The Board is responsible for providing strategic direction, leadership, support and guidance to settle. In March 2021, we adopted the principles of the National Housing Federation [NHF] Code of Governance 2020.

The governance framework of settle, its constitution and the composition of its Board and respective committees is based on these requirements. The Board’s responsibilities include:

- setting the strategic direction of the Group and setting out its mission, vision and values.

- approving settle’s key strategies, long-term plans and objectives.

- financial control and risk management.

- monitoring settle’s performance; and

- accountability to stakeholders, especially our residents.

The settle Governance Framework in 2022/23 included four Committees of the Board, Operating Regulations, Financial Regulations and a Schedule of Delegated Authority. Following recommendations from the external board effectiveness review carried out by Campbell Tickell in the spring of 2021, the Board approved and implemented the agreed changes to the governance framework including a re-constituted Committee structure, each with delegated responsibilities set out in Terms of Reference to support the work of the Board:

- Audit and Risk Committee

- Development and Asset Committee (formerly Development Committee)

- Nominations and Remuneration Committee (formerly People and Governance Committee)

- Operations Committee; and

- Treasury Task and Finish Group.

Board Delegation

In order to operate effectively and ensure appropriate governance in its business-critical areas the Board has delegated authority to its committees.

The Board agreed new Terms of Reference for each Committee, and each Committee reported regularly to the Board during the year on how it discharges its functions. In September 2022 the Board also reviewed and updated its Operating Regulations and the matters reserved for Board decision that cannot be delegated. The remit of the Committees is detailed earlier in this report on Strategic Report.

Statement on Internal Controls Assurance

The Board has overall responsibility for risk management at settle and acknowledges its role and responsibility for ensuring that we have in place an effective system of internal control that is appropriate for its operations and for reviewing its effectiveness. The system of internal control is designed to manage, rather than eliminate the risk of failure to achieve business objectives and to provide reasonable, but not absolute, assurance that key business objectives will be achieved. It also exists to give reasonable assurance about the preparation and reliability of financial information and the safeguarding of assets.

The process of identifying, evaluating and managing significant risk is ongoing and has been in place throughout the period of this Financial Statement. In meeting its responsibilities, the Board has adopted a risk-based approach to internal controls, which is embedded within normal management and governance processes. This approach includes the regular evaluation of the nature and extent of risks.

Whilst the Board has ultimate responsibility for the system of internal control it has delegated authority to the Audit and Risk Committee to regularly review its effectiveness. It does this by reviewing the effectiveness of the systems across the spectrum of the framework and includes, risk registers, internal audit reports, fraud reports, the external audit management letter and specialist reviews.

Key elements of our internal control framework include:

- A formally constituted Board and Committee structure, with approved rules, terms of reference and scheme of delegation;

- An annual review of compliance with the NHF Code of Governance Review and annual assessment of compliance with the RSH regulatory standards to the Board;

- A Code of Conduct for Non-Executive Directors and Colleagues in settle, including a Board and Committee Behaviour, Competency and Expertise Framework and Declarations of Interest Policy;

- A comprehensive Non-Executive Director appraisal process and Governance Effectiveness Review. An induction and learning and development programme are in place to ensure Non-Executive Directors remain professionally updated and have the skills to meet the needs of the business;

- Clear responsibilities for the identification, evaluation and control of risk. All Committees and Board consider risks throughout the year. The Chief Executive and the Audit and Risk Committee are responsible for reporting any significant changes to the Board;

- Audit and Risk Committee approved internal audit plan and internal audit reporting at Committee meetings. Our Internal Auditors RSM completed seven audits this financial year, four with substantial assurance and three concluded reasonable assurance. The Board receive an annual Internal Audit report from RSM;

- Regular reporting by the appropriate committee or the Board of risk information;

- Quarterly directorate specific internal Control and Risk Assurance Statements, completed by the senior leadership team and reported to the Audit and Risk Committee;

- Key health and safety issues reported to the Health, Safety and Wellbeing Board, the Audit and Risk Committee and the Board;

- Robust strategic and financial business planning processes, including financial reporting procedures that include detailed budgets, forecasts and cash flow for the year ahead;

- The Board regularly reviews key performance indicators to assess progress towards the achievement of key business issues, objectives, targets and outcomes;

- A Data Protection Policy and Speak Up Policy (Whistleblowing) are in place;

- A detailed approach to treasury management including regular monitoring of loan covenants and stress testing, aligned with settle’s strategic risk and assurance activity, inclusive of the Assets and Liabilities Register. A recovery framework and plan are in place;

- Regular monitoring of loan covenants and loan facilities;

- Chief Executive’s internal control assurance statement to the Audit and Risk Committee and the Board;

- Regular updates and reporting by the external auditors; and

- Policies and procedures to reduce the risk of fraud, bribery and money laundering.

During 2022/23 the internal auditors RSM issued no reports with a partial or minimal assurance opinion and concluded that settle has in place an appropriate framework for risk management, governance and internal control, subject to the identified further enhancements reported in internal audit reports.

Whilst not exhaustive the above represents the key elements of the existing system of internal control. Key work continues in embedding an integrated risk management culture across settle with our triannual external governance review due to take place in 2024.

In concluding its review, the Board is satisfied with the adequacy of these controls for the year ending 31 March 2023, and for the period to the date of signing the financial statements.

Modern Slavery Act 2015

As turnover exceeds £36m for the period under review, under section 54(1) of the Modern Slavery Act 2015, we produced a Modern Slavery and Human Trafficking Statement for the year ending March 2023.

This statement sets out the steps we have taken during the year to ensure there is no modern slavery (including human trafficking) in the business and supply chains. It is approved by the Board and will continue to be reviewed and updated as necessary or on an annual basis. The statement is published on our website.

Compliance with the RSH Governance and Financial Viability Standard

Following an in-depth assessment [IDA], the results of which were published in January 2022, the Regulator of Social Housing’s stability check saw settle retain the G1 grade for governance and V1 for viability. In November 2022 the Regulator regraded the V1 to V2; the rationale given at the time was our plan to increase investment in existing homes, including works to improve energy efficiency, and forecasted increases in development costs, in combination with the current economic uncertainty in relation to inflation and interest rates.

We assess our compliance with the RSH Governance and Viability Standard annually. The Board was assured that we met all the requirements of the Standard at its meeting on 20 May 2023.

settle considers it has therefore achieved full compliance with the RSH Governance and Viability Standard.

Compliance with the National Housing Federation's Code of Governance 2020

settle adopted the National Housing Federation’s 2020 Code of Governance (the Code) with effect from 1 April 2022. The Board considers compliance against each of the provisions of the Code on an annual basis. Following review on 20 May 2023 the Board was assured that settle is fully compliant with the Code.

settle has therefore achieved full compliance with the NHF Code of Governance 2020.

Board Members’ Responsibilities

Statement of the responsibilities of the Board for the annual report and financial statements

The Board members are responsible for preparing the Report of the Board of Directors and the financial statements in accordance with applicable law and regulations.

Co-operative and Community Benefit Society law and social housing legislation require the Board members to prepare financial statements for each financial year in accordance with United Kingdom Generally Accepted Accounting Practice (United Kingdom Accounting Standards and applicable law).

In preparing these financial statements, the Board members are required to:

- select suitable accounting policies and then apply them consistently;

- make judgements and accounting estimates that are reasonable and prudent;

- state whether applicable UK Accounting Standards and the Statement of Recommended Practice: Accounting by registered social housing providers 2018 have been followed, subject to any material departures disclosed and explained in the financial statements; and

- prepare the financial statements on the going concern basis unless it is inappropriate to presume that the group and association will continue in business.

The Board members are responsible for keeping adequate accounting records that are sufficient to show and explain the group and association’s transactions and disclose with reasonable accuracy at any time the financial position of the group and association and enable them to ensure that the financial statements comply with the Co-operative and Community Benefit Societies Act 2014, the Co-operative and Community Benefit Societies (Group Accounts) Regulations 1969, the Housing and Regeneration Act 2008 and the Accounting Direction for Private Registered Providers of Social Housing 2022. They are also responsible for safeguarding the assets of the group and association and hence for taking reasonable steps for the prevention and detection of fraud and other irregularities.

The Board is responsible for ensuring that the report of the Board is prepared in accordance with the Statement of Recommended Practice: Accounting by registered social housing providers 2018.

Financial statements are published on the group and association’s website in accordance with legislation in the United Kingdom governing the preparation and dissemination of financial statements, which may vary from legislation in other jurisdictions. The maintenance and integrity of the group and association’s website is the responsibility of the Board members. The Board members' responsibility also extends to the ongoing integrity of the financial statements contained therein.

Disclosure of Information to the auditor

The Board directors who held office at the approval of this Report of the Board of Directors confirm that, so far as they are each aware, there is no relevant audit information of which the Company’s auditors are unaware; and each director has taken all the steps that he/she ought to have taken as a director to make themselves aware of any relevant audit information and to establish that the Company’s auditors are aware of that information.

Auditor

BDO LLP was re-appointed as auditor during the year. BDO is willing to continue in office and the Audit and Risk Committee will make a recommendation to the Board regarding the continuation of BDO LLP in post as Auditor for the forthcoming year. BDO has provided services in relation to the annual audit of the Group and taxation advice in the year.

In preparing this Financial and Operating Review and Board Report, the Board has followed the principles set out in the SORP 2018

The Financial and Operating Review and Board Report was approved by the Board on 20 July 2023 and signed on its behalf by:

Sally Veitch Chair