Financial and Operating Review

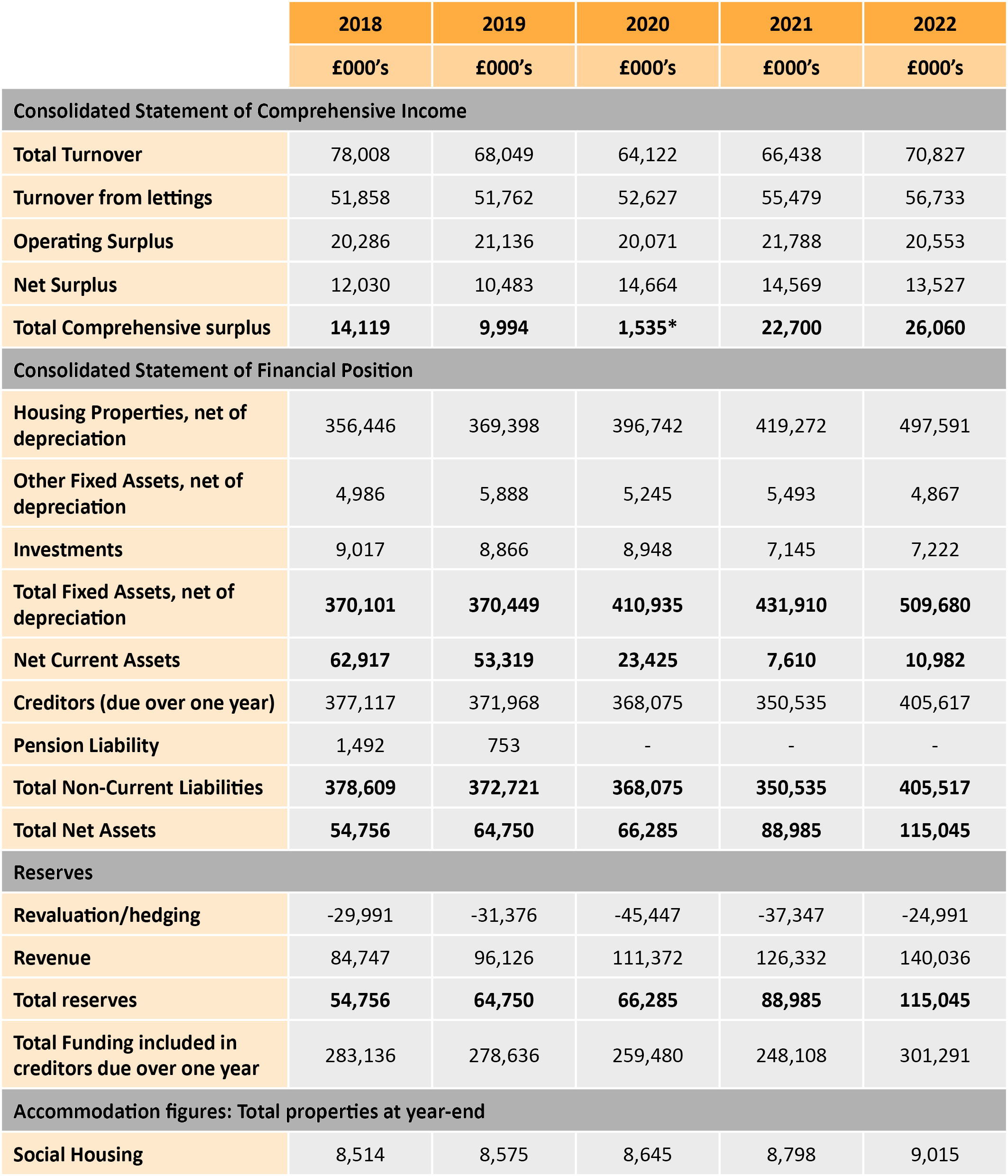

Five-year summary

The five-year summary shows our continually strong financial position. In the five years from 2018, the business has delivered strong operating surpluses through the landlord business. Changes in turnovers between years primarily reflect market sales activity that had been in our pipeline. We expect to see smoother growth in turnover as we deliver on our current development pipeline that provides a consistent number of new rented homes and those offering low-cost shared ownership options.

* £14m movement for financial instruments

Over the last five years, operating surpluses have been consistently over £20m. This represents a strong operating performance against a backdrop of economic and political uncertainty. Fundamental to this has been the delivery of our core social housing lettings activities which have maintained a strong performance, even though over 90% of our properties have genuinely low-cost social rents.

Long-term liabilities are detailed in the financial statements and reflect government grants, pension liabilities and the market value of financial instruments. The pension liability position of £0m relates to our Local Government Pension Scheme, which has been closed to new members since 2003. While we are not in a deficit position, the inability to recoup any residual surplus once the scheme is finished means we cannot legally recognise the positive year-end position.

The sections below provide a deeper analysis of the key financial elements of settle’s business:

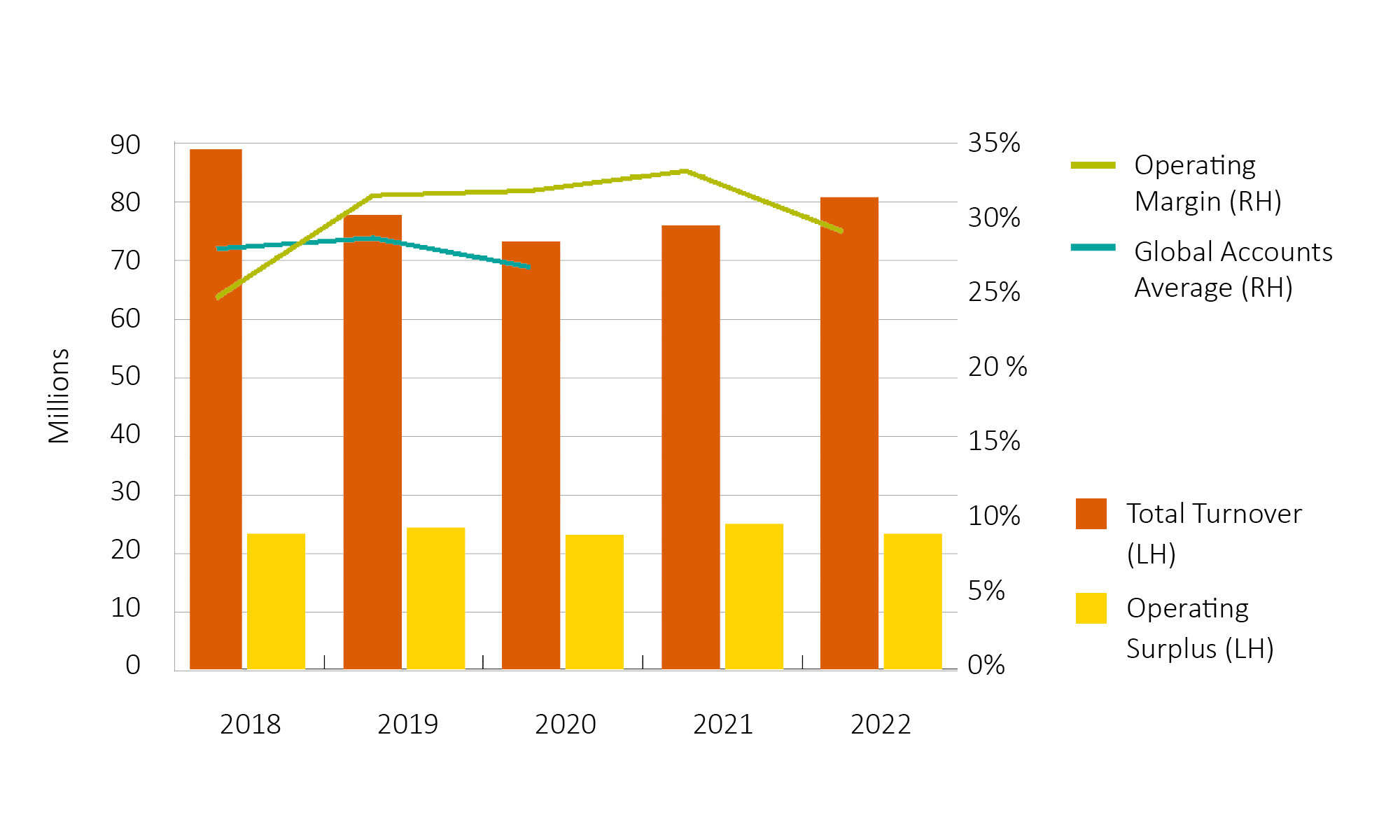

Turnover and surplus

The Regulator of Social Housing produces an annual Global Accounts providing financial information for individual providers and an overview of the social housing sector. The table above shows the comparative of settle to the Global Accounts Average for previous years.

Turnover has remained strong with variances between years largely driven by the timings of sales completions and varying levels of market sale.

Whilst the operating margin has remained healthy throughout the period and consistently above the global average, it fell slightly below 30% for the first time in several years in 2021/22. This was the result of a combination of various factors, the key contributor to this being the 34% uplift in repairs requested in year (17,261 2020/21 and 20,357 2021/22). In order to continue to aim for our turnaround targets and meet demand we had to increase our use of subcontractors and as a result settle completed 21,842 responsive repair jobs which represented a 27% uplift on prior year (17,141 jobs 2020/21) . Increased material costs and a write-off following a review of the asset register also contributed to the fall in margin.

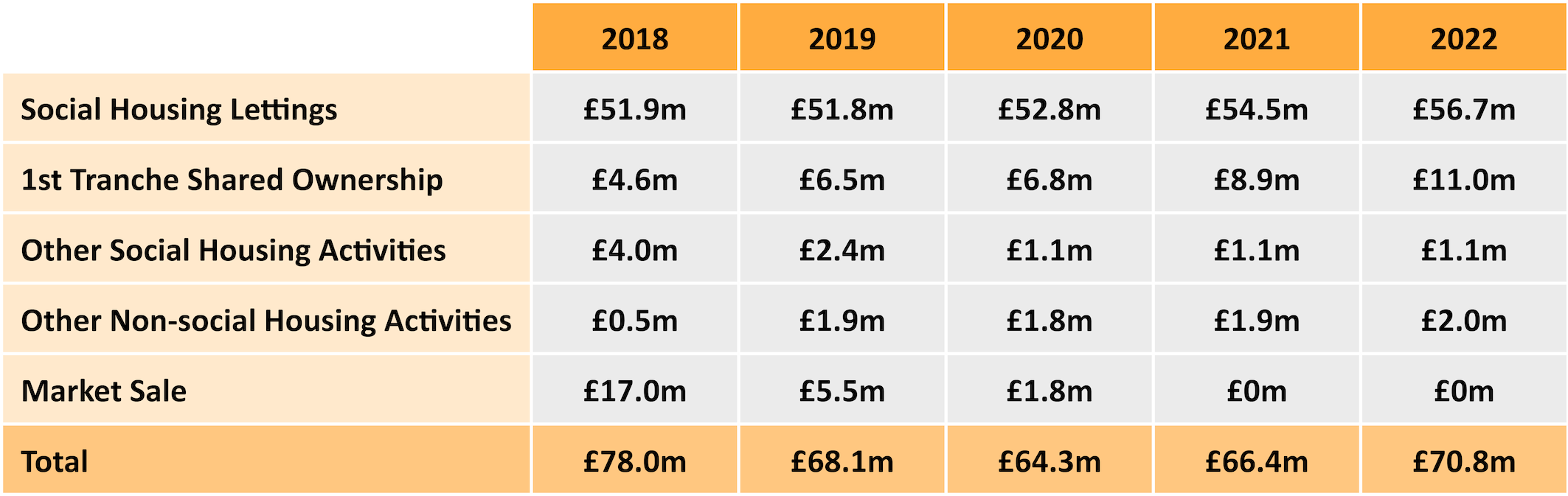

Turnover breakdown

80% of our turnover in 2022 relates to social housing lettings, reflecting the continued commitment we have to the provision of truly affordable rented properties.

Our conscious decision to move to a development strategy that focuses on affordable housing rather than market sale can be clearly seen from looking over the past 5-year performance. We have focussed our attention on delivering much-needed affordable housing which provides reliable income streams.

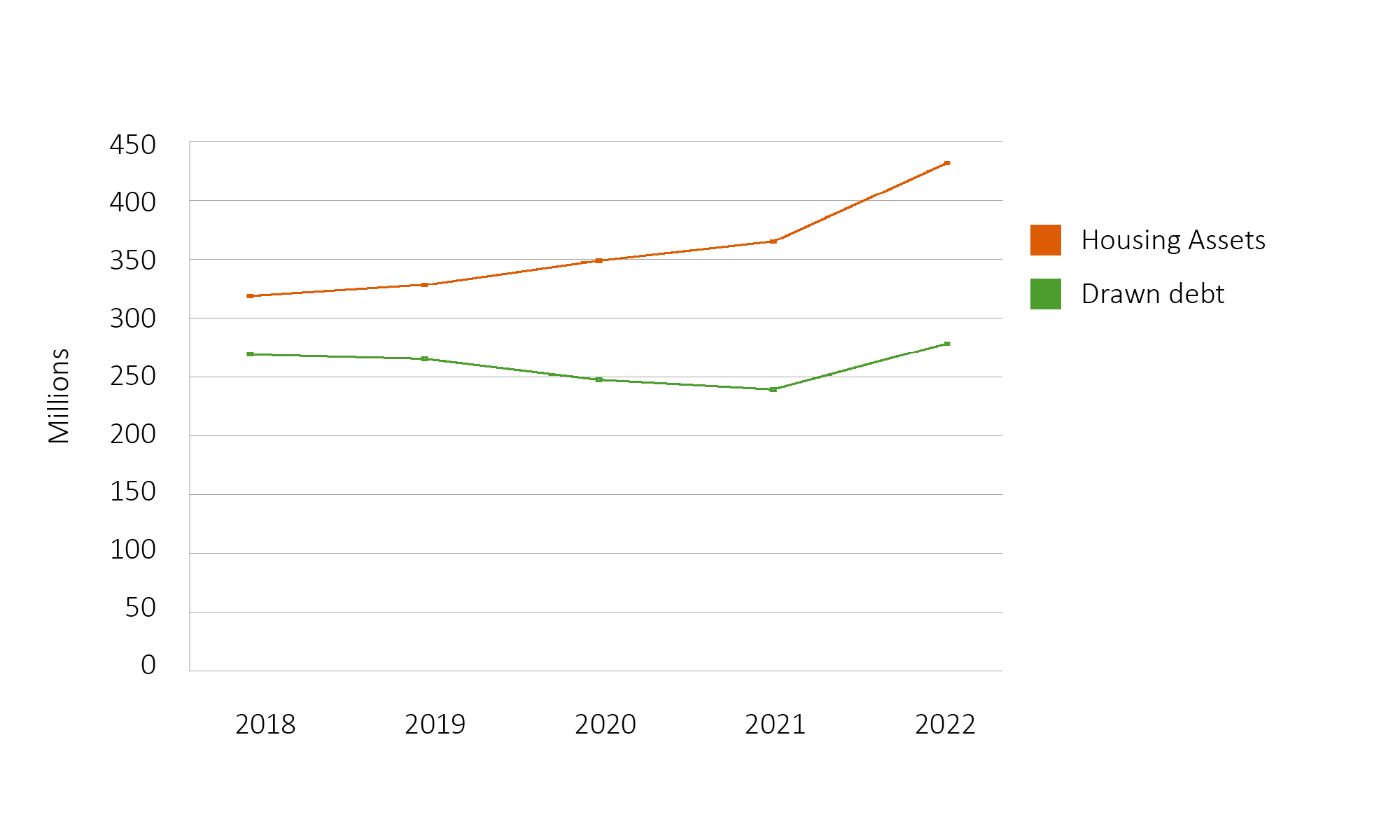

Assets and debt

Additional borrowing in 2021/22 has increased our long term debt. This provides settle with opportunities to increase borrowing and expand our future development programme in line with our target of building 1,500 homes by 2024.

Liquidity

settle’s treasury strategy includes strict targets to ensure that sufficient liquidity is in place to fund at least 18 months of future commitments.

As at 31st March 2022, our liquidity headroom was £155.1m. We have consciously increased the amount of funds we have access to as we have increased our development ambitions. This liquidity position is sufficient to ensure our committed developments are fully funded.

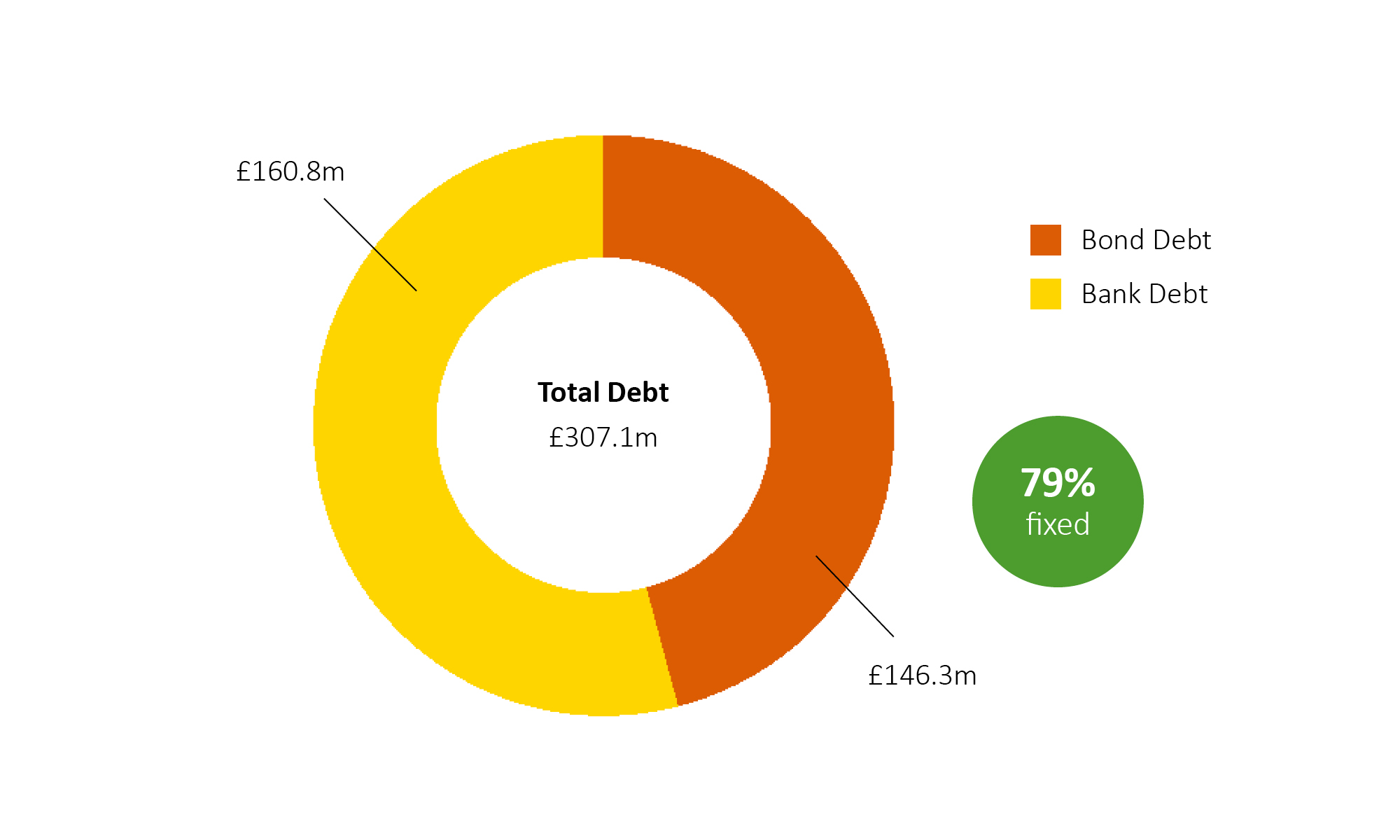

Drawn debt breakdown

settle currently has £307.1m of drawn debt, split between bank loans and bonds. The long-term nature of our debt portfolio ensures there is limited refinancing risk in the short to medium term.

79% of our portfolio is currently fixed by either stand-alone derivatives or fixed rate bonds. This represents a comfortable mixture of interest rate management and flexibility within the debt to take advantage of potential fundraising opportunities.

Operating Review

Investment in existing assets

As our financial review demonstrated, settle is a business that is fundamentally focussed on affordable housing. Provision of genuinely affordable rented homes remains the core component of the business. As our corporate strategy sets out, delivering good services is of huge importance to us and this means that we continue to invest in our existing stock. During the year, we invested £8.3m (2021 £3.8m) in capital improvements to existing homes.

Our 2021/22 long-term financial plan was aligned to the results of our stock condition surveys with an additional £16m built into the plan to ensure that 80% of our homes are at EPC Band C or better. Stock condition surveys are being carried out over a 5-year cycle so that we continue to have a robust understanding of the performance of our asset base, together with clarity on where future investment will need to be made in our stock. This allows us to forward plan our asset management work, which in turn can drive procurement efficiencies.

An additional £16m built into the plan to ensure that 80% of our homes are at EPC Band C or better.

Service delivery

In 2021/22 we completed all non-emergency repairs within an average of 24 days, closing the year with an encouraging improvement in the second half from a peak in September of 28 days. The core backlog of repairs resulting from the 2020/21 pandemic lockdowns has been a challenge in-year due to in-house and contractor resource tensions, most specifically in the first half-year period. The target for this metric at 18 days was not achieved however, most of the aged repairs in the backlog have been completed paving the way for a consistently reducing average through 2022/23.

Addressing the resource tensions experienced in the first half of 2021/22 and installing additional capacity for repairs following a restructure of the team, the backlog of repairs continues to reduce with an expectation that performance will accelerate towards the 2022/23 target of 15 days by Q3 this financial year.

Voids performance in terms of turnaround times ended the year at 43 days for major voids (target 28 days) and 23 days for standard voids (target 14 days), both measured from termination to commencement of tenancy. The period of measure combines the repair work required to bring the property to a settle Void Standard with the lettings and offer period through to commencement of a new tenancy.

Development and sales

During 2021/22 we increased our housing portfolio by purchasing 138 social housing properties from another Social Housing Provider. These homes are in Watford, Dacorum and Three Rivers, complementing our existing operating base.

We also received handover of 120 homes, all were affordable i.e. social rent, affordable rent and shared ownership and we had practical completion confirmed on a further 62 homes, taking total completions for 2021/22 to 182 homes (2020/21 172 homes). Our corporate plan sets out to deliver 1,500 homes by 2024 of which at least 90% are affordable. An average void period of 13 days and a first tranche sales average of 43% reflects that there is still a high demand for shared ownership as a means for people to access home ownership in a market where they are priced out of purchasing on the open market. This demand continues to help to cross-subsidise the development of affordable low-cost rented properties as well.

As at 31 March 2022, we already have 852 homes where we are contractually committed and will be building these in future years, this demonstrates the acceleration we are making and the reputation we are developing with key stakeholders in our localities.

A place where colleagues love to work

We have been particularly proud of the way in which colleagues have continued to support our customers and each other. We have made great strides in progressing our people strategy that seeks to ensure that settle is seen as a place where colleagues love to work. In particular we have:

- Introduced hybrid working following the pandemic and continue to support colleagues through various wellbeing initiatives.

- Embedded our settle way behaviour framework to strengthen how we demonstrate our values and improve the way we behave with residents to improve outcomes.

- Introduced an equality, diversity and inclusion strategy which is supported by our value everyone colleague group, ensuring everyone feels valued and included in the organisation.

- Made sure we understand colleague performance through our data, which enables us to make performance-related decisions to ensure we continue to deliver the best outcomes to our customers.

- Reviewed our renumeration package; we continue to offer an excellent package that retains and attracts colleagues to settle.

- Made strides forward on management development and the roll out of the CIH professional standards development offering.

An environmentally sustainable business

As a social purpose organisation, we know it is important that we operate in an environmentally sustainable manner. We’re committed to working in a sustainable way across all that we do at settle, making sure this delivers real benefits for our residents and communities.

Board agreed our first sustainability strategy in January 2021 that focussed on the following key areas to meet our strategic ambition:

- Tackling fuel poverty amongst our residents.

- Investing in our existing homes and neighbourhoods with a specific focus on community-based approaches to sustainability.

- Creating sustainable new homes.

- Supporting the local economy and developing sustainable supply chains.

- Ensuring that our sustainability credentials act as an attractor for existing and future colleagues.

2021/22 has been very much a year of data collection to underpin our future work programmes. We have conducted our first carbon baselining exercise which identified that over 90% of our emissions came from our existing homes. This information supports our asset investment plans; taking a fabric first approach to ensuring that homes are thermally efficient.

We also undertook our first SHIFT (Sustainable Homes Index For Tomorrow) accreditation and were delighted to be awarded Silver. The analysis also identified where we could continue to progress and this has helped support our 2021/22 delivery plans.

Additionally, we have formed a sustainability partnership named ‘Greener Herts’ with Hertfordshire-based housing associations B3 Living and Watford Community Homes, led by a sustainability consultant. As a partnership, we are working on collective projects to achieve Net Zero Carbon by 2050. For example, we have partnered with energy-saving specialist ‘WarmFront’ to survey our homes with thermal imaging, allowing us to plan where to invest in retrofitting and to access ECO funding. We will also be submitting a collective bid for Wave 2 of the Social Housing Decarbonisation Fund when applications open. Our partnership has a ‘Green Panel’ for residents to share their thoughts on sustainability issues and projects, and the ‘Greener Herts’ website provides blogs and articles on sustainability for residents to engage with.

Social Purpose

Social purpose is at the heart of settle. During 2021/22, colleagues delivered over 737 hours of ‘Giving Back Days’, volunteering their time across a range of activities from garden clearance and litter picking to helping at food banks. Our 2019-2024 strategy reinforces our commitment to our social purpose with a target of 3,000 Giving Back Days delivered by 2024.

Equality, Diversity and Inclusion

Through every part of our work at settle supporting our colleagues, customers and communities, we are committed to ensuring that all individuals have an equal opportunity to make the most of their lives. Equality, diversity and inclusion (EDI) plays a central role in supporting the delivery of our social purpose and sits at the heart of everything we do. Our culture at settle is inclusive and embraces and celebrates the differences in everyone.

Our EDI strategy sets out our approach to equality, diversity, and Inclusion, and outlines the commitments we are making over the next three years. It is a ‘living’ document that can be adapted in line with the changing needs of our customers, colleagues, and partners, as well as the external environment. Additionally, we fully support the importance of greater transparency and disclosure on ethnicity pay as part of a business’s ESG reporting. As part of this we report on ethnicity pay in the same way that organisations are required to report on gender pay, using the same calculation methodology set out by the Government Equalities Office.

The calculations of our ethnicity pay gap show our mean pay gap is -0.3% and median pay gap is -1 per cent. This means that on average, minoritised ethnic colleagues earn a small amount more than non-minoritised ethnic colleagues.

We are clear that the promotion and awareness of diversity and inclusion issues at all levels of an organisation can bring many benefits such as higher performance, greater innovation, and a more positive environment for all. We also know that reviewing our diversity offer for residents will ensure we are providing the right level of support, improve access to services, establish communities and meet the needs of our residents.

As next steps we focus on our EDI strategy and continue to deliver on our EDI action plan that spans over the next 3 to 5 years. We are committed to nurturing employability across our communities, with a particular focus on progressing young people and women into alternative career paths. We will build on the work of our ‘value everyone’ group which looks at celebrating diversity amongst our colleagues. Additionally, we continue to provide training and development opportunities to raise awareness of diversity and inclusion related topics. Some of our focus points over the next year include:

- Using data driven processes to address any bias and increase opportunity

- Expanding our network and working with local groups

- Taking an intersectional approach to our diversity and inclusion strategy

- Progressing and retaining our talent

- Removing recruitment barriers.