Notes to the Financial Statements 1-2

1 Legal Status

The Association is registered under the Cooperative and Community Benefit Society Act 2014 at Blackhorse Road, Letchworth Garden City, Hertfordshire, SG6 1HA and is a registered housing association. Registered charity number: 30003R. settle is a public benefit entity in accordance with FRS102.

settle group has one subsidiary, Rowan Homes (NHH) Limited, which is a registered company developing houses for sale.

2 Accounting Policies

Basis of preparation The financial statements have been prepared in accordance with applicable law and UK accounting standards (United Kingdom Generally Accepted Accounting Practice) which for settle Group (the “Group”) includes the Cooperative and Community Benefit Societies Act 2014 (and related group accounts regulations), the Housing and Regeneration Act 2008, FRS 102 “the Financial Reporting Standard applicable in the United Kingdom and the Republic of Ireland” the Statement of Recommended Practice (SORP) for Registered Social Housing Providers 2018, the Accounting Direction for Private Registered Providers of Social Housing 2019.

The accounts are prepared under the historic cost basis except for the modification to a fair value basis for certain financial instruments and investment properties as specified in the accounting policies below. The preparation of financial statements in compliance with FRS 102 requires the use of certain critical accounting estimates. It also requires Group management to exercise judgement in applying the Group's accounting policies.

Disclosure exemptions The individual accounts of settle group have adopted the following disclosure exemptions:

- the requirement to present a statement of cash flows and related notes;

- financial instrument disclosures, including;

- categories of financial instruments; - items of income; - expenses; - gains or losses relating to financial instruments; and - exposure to and management of financial risks.

Basis of consolidation

The Consolidated Group financial statements include the accounts of the Association and its subsidiary, Rowan Homes (NHH) Limited (together, ‘the Group’) as if they formed a single entity. Intercompany transactions and balances between group companies are therefore eliminated in full.

The consolidated financial statements incorporate the financial statements of the Association and its subsidiary, controlled by the Group. Control is achieved where the Group has the power to govern the financial and operating policies of an entity so as to obtain benefits from its activities.

Going concern

The Group’s business activities, its current financial position and factors likely to affect its future development are set out within the strategic report. The Group has long-term debt facilities in place which provide adequate resources to finance committed reinvestment and development programmes, along with the Group’s day to day operations. The Group also has a long-term business plan which shows that it is able to service these debt facilities whilst continuing to comply with lenders’ covenants.

On this basis, the Board has a reasonable expectation that the Group has adequate resources to continue in operational existence for the foreseeable future, being a period of at least twelve months after the date on which the report and financial statements are signed. For this reason, it continues to adopt the going concern basis in the financial statements.

Significant judgements and estimation uncertainty

Estimates and judgements are continually evaluated and are based on historical experience and other factors, including expectations of future events that are believed to be reasonable under the circumstances.

- Fair value of financial instruments - interest rate swap contracts allow the company to swap the prevailing three-month LIBOR rate of interest for a fixed rate, on a defined level of principal. The company has three of these contracts, which are independently measured at fair value. The fair value is used in the accounts and is derived from the difference between the fixed and variable rate and discounted across the relevant period of the yield curve. Note 33 details the financial instruments.

- Defined benefit pension scheme - actuarial assumptions have been made in determining the valuation. Note 27 details the assumptions used.

- Component Useful Economic Life (UEL) – The Group identified the major components of its housing properties over its estimated useful economic life. The Group depreciates the major components over UELs from 15 to 100 years (Depreciation of housing properties).

- Impairment - Fixed Assets including Housing properties are assessed annually for impairment indicators. Where indicators are identified, an assessment for impairment is undertaken comparing the scheme's carrying amount to its recoverable amount. Where the carrying amount of a scheme is deemed to exceed its recoverable amount, the scheme is written down to its recoverable amount. The resulting impairment loss is recognised as operating expenditure. Where a scheme is currently deemed not to be providing service potential to the Association, its recoverable amount is its fair value less costs to sell.

- Properties for sale - Shared ownership first tranche sales, completed properties for outright sale and property under construction are valued at the lower of cost and net realisable value. Cost comprises materials, direct labour and direct development overheads. Net realisable value is based on estimated sales price after allowing for all further costs of completion and disposal.

Information about estimates and assumptions that have the most significant effect on recognition and measurement of assets, liabilities, income and expenses is provided below. Actual results may be substantially different.

Turnover and revenue recognition

The Group’s and Association’s principal activities are the management and development of affordable and supported housing.

Turnover comprises rental income receivable in the year, income from shared ownership first tranche sales, sales of properties built for sale, other services included at the invoiced value (excluding VAT where recoverable) of goods and services supplied in the year and grants receivable in the year. Rental income is recognised from the point when properties under development reach practical completion or otherwise become available for letting, net of any voids. Income from first tranche sales and sales of properties built for sale is recognised at the point of legal completion of the sale. Charges for support services funded under Supporting People are recognised as they fall due under the contractual arrangements with Administering Authorities.

Employee Benefits

A liability is recognised to the extent of any unused holiday pay entitlement which has accrued at the statement of financial position date and carried forward to future periods. This is measured at the undiscounted salary cost of the future holiday entitlement accrued at the statement of financial position date.

Termination benefits are recognised as an expense when the group is demonstrably committed, without realistic possibility of withdrawal to a formal detailed plan to terminate employment.

Short-term employee benefits and contributions to defined contribution plans are recognised as an expense in the period in which they are incurred.

Pensions

The Group operates a defined benefit scheme (LGPS) contracted out of the state scheme for employees, who were transferred under TUPE from the NHDC (now North Herts Council) scheme.

The pension scheme, which is closed to new employees, is valued every three years by a professionally qualified independent actuary, more often when there are changes in circumstances, the rates of contribution being determined by the actuary. In the intervening years the actuary reviews the continuing appropriateness of the rate.

For the LGPS, assets are measured at fair values. Scheme liabilities are measured on an actuarial basis using the projected unit method and are discounted at appropriate high quality corporate bond rates. The net surplus or deficit, adjusted for deferred tax, is presented separately from other net assets in the statement of financial position. A net surplus is recognised only to the extent that is recoverable by the Group through reduced contributions or through refunds from the plan.

The current service cost and costs from settlements and curtailments are charged against operating surplus. Past service costs are recognised in the current reporting period. Interest is calculated on the net defined benefit liability. Re-measurements are reported in other comprehensive income.

Interest payable

IInterest is capitalised on borrowings to finance the development of qualifying assets to the extent that it accrues in respect of the period of development if it represents:

(a) interest on borrowings specifically financing the development programme after deduction of related grants received in advance; or

(b) a fair amount of interest on borrowings of the Association as a whole after deduction of Social Housing Grant (SHG) received in advance to the extent that they can be deemed to be financing the development programme.

Other interest payable is charged to income and expenditure in the year.

Taxation

Current tax is recognised for the amount of income tax payable in respect of the taxable surplus for the current or past reporting periods using the tax rates and laws that have been enacted or substantively enacted by the reporting date.

The Group charges Value Added Tax (VAT) on some of its income and is able to recover part of the VAT it incurs on expenditure. The financial statements include VAT to the extent that it is suffered by the Group and not recoverable from HM Revenue and Customs. The balance of VAT payable or recoverable at the year-end is included as a current liability or asset.

Financial instruments

Financial instruments which meet the criteria of a basic financial instrument as defined in Section 11 of FRS 102 are accounted for under an amortised historic cost model. Non-basic financial instruments are recognised at fair value using a valuation technique with any gains or losses on the ineffective financial instruments being reported in surplus or deficit and any effective financial instruments being recorded in in the financial instrument hedging reserve. At each year-end, the instruments are revalued to fair value.

Intangible fixed assets

Software is treated as an intangible asset and is amortised on a four-year straight-line basis.

Housing properties

Housing properties are properties held for the provision of social housing or to otherwise provide social benefit. Housing properties are principally properties available for rent and are stated at cost less depreciation.

Completed housing and shared ownership properties are stated at cost, less subsequent accumulated depreciation and accumulated impairment losses. Impairment reviews are made with sufficient regularity to ensure the carrying amount does not materially differ from the fair value or the properties at year-end.

Housing properties under construction are stated at cost. Cost includes the cost of acquiring land and buildings, development costs, interest charges incurred during the development period and expenditure incurred in respect of improvements.

Works to existing properties which replace a component that has been treated separately for depreciation purposes, along with those works that result in an increase in net rental income over the lives of the properties, thereby enhancing the economic benefits of the assets, are capitalised as improvements.

Shared ownership properties are split proportionally between current and fixed assets based on the element relating to expected first tranche sales. The first tranche proportion is classed as a current asset and related to sales proceeds included in turnover, and the remaining element is classed as fixed asset and included in the housing properties at cost, less any provisions needed for depreciation or impairment.

Depreciation of housing properties

The Group separately identifies the major components which comprise its housing properties, charging depreciation thereon, so as to write-down the cost of each component to its estimated residual value, on a straight-line basis, over its estimated useful economic life.

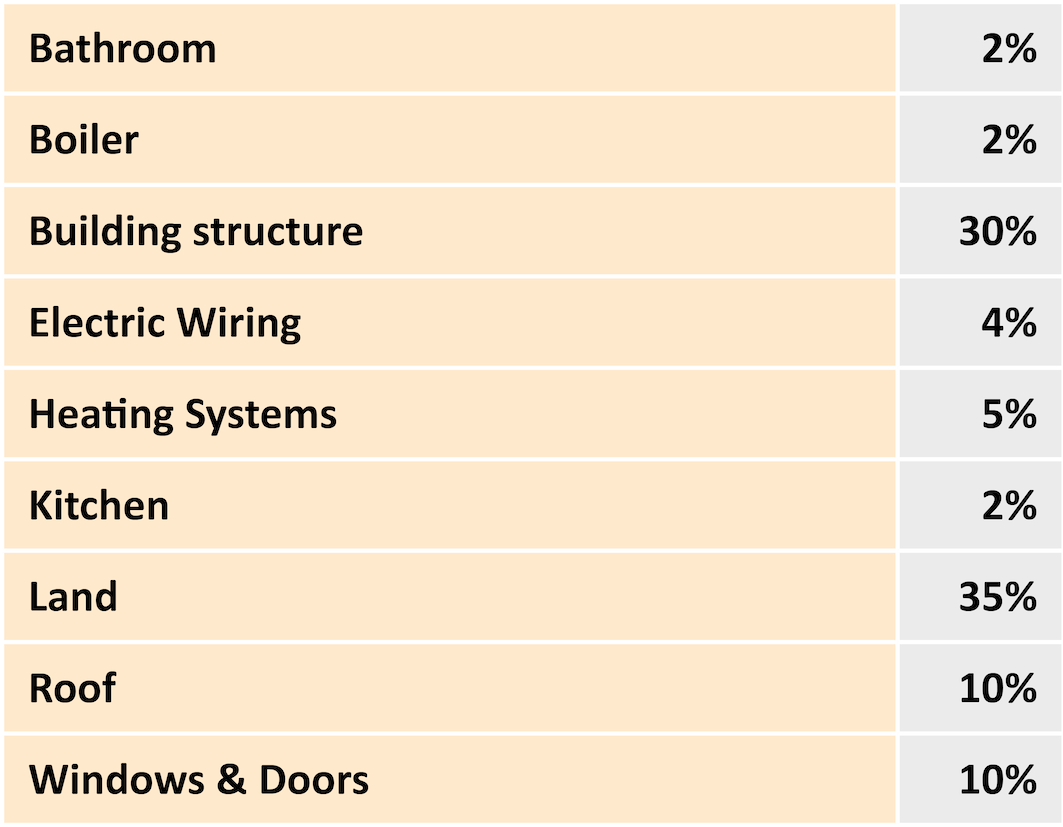

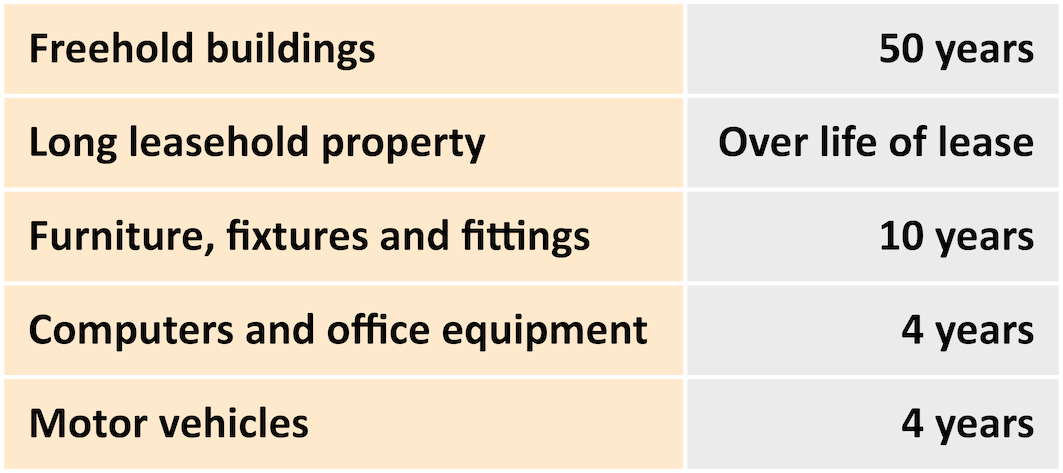

The Group depreciates the major components of its housing properties over the following useful economic lives:

Freehold land is not depreciated.

Leasehold properties are amortised over the life of the lease or their estimated useful economic lives in the business, if shorter.

Upon completion or acquisition of a property, cost of sales is apportioned at the following rates:

Other tangible fixed assets

Other tangible fixed assets are measured at cost less accumulated depreciation and any accumulated impairment losses.

Depreciation is provided evenly on the cost of other tangible fixed assets to write them down to their estimated residual values over their expected useful lives. No depreciation is provided on freehold land.

The principal annual rates used for other assets are:

Gains or losses arising on the disposal of other tangible fixed assets are determined as the difference between the disposal proceeds and the carrying amount of the assets and are recognised as part of the surplus/deficit for the year.

Investment properties

Investment properties consist of commercial properties and other properties not held for the social benefit or for use in carrying out business activities. Investment properties are measured at cost on initial recognition and subsequently at fair value as at the year-end, with changes in fair value recognised in the statement of comprehensive income.

Donated land and other assets

Land and other assets donated by local authorities and other government sources is capitalised at the fair value of the land at the time of the donation. Where the land is not related to a specific development and is donated by a public body an amount equivalent to the increase in value between fair value and consideration paid is treated as non-monetary grant and recognised on the statement of financial position as a liability. The terms of the donation are deemed to be performance related conditions. Where the donation is from a non-public source, the value of the donation is included as income.

On disposal of an asset for which non-monetary government grant was received by the social landlord any unamortised grant remaining within liabilities in the statement of financial position is derecognised and recognised as income in the statement of comprehensive income.

Government grants

Government grants include grants received or receivable from the Homes England, local authorities and other government bodies.

Government grants are recognised at the fair value of the asset received or receivable when there is reasonable assurance that the grant conditions will be met and the grants will be received. Reasonable assurance is achieved when the grant provider gives notification of when payment will be made or the grant is received.

Government grants received for housing properties are recognised in income over the useful economic life of the structure (excluding land) of the asset under the accruals model. Grants for shared ownership properties, which are not depreciated, are amortised over 25 years.

Government grants relating to revenue are recognised as income over the periods when the related costs are incurred once reasonable assurance has been gained that the company will comply with the conditions and the funds will be received.

Other grants

Grants received from non-government sources are recognised using the performance model. Grants are recognised as income when the associated performance conditions are met.

Community Benefit Fund (CBF) agreement

A community benefit agreement exists between the Group and North Hertfordshire District Council to record the surpluses on sales of assets that were part of the original stock transfer and the savings made under the VAT plan that had been approved by HM Revenues and Customs. A contracted sum which is indexed linked to RPI for the current year is recognised as income to settle, the remaining proceeds is recycled to the Fund and disclosed under creditors falling due within one year.

Disposal Proceeds Fund (DPF)

Receipts from Right to Acquire (RTA) Sales are required to be retained in a ring-fenced fund that can only be used for providing replacement housing. Any sales receipts less eligible expenses held within disposal proceeds fund, which it is anticipated will not be used within one year is disclosed in the statement of financial position under creditors due after more than one year. The remainder is disclosed under creditors falling due within one year.

The DPF scheme has been abolished, replaced by the Recycled Capital Grant Fund (RCGF) which is disclosed separately, though the historical balances remain until used or repaid.

Creditors

Short term trade creditors are measured at the transaction price. Other financial liabilities, including bank loans, are measured initially at fair value, net of transaction costs, and are subsequently measured at amortised cost using the effective interest method.

Debtors

Short term debtors are measured at transaction price, less any impairment. Where deferral of payment terms have been agreed at below market rate, and where material, the balance is shown at the present value, discounted at market rate.

Loans receivable are measured initially at fair value, net of transaction costs, and are subsequently measured at amortised cost using the effective interest method, less any impairment.

Provisions for liabilities

Provisions are recognised when the Group has a present obligation (legal or constructive) as a result of a past event, it is probable that the Group will be required to settle the obligation, and a reliable estimate can be made of the amount of the obligation. The amount recognised as a provision is the best estimate of the consideration required to settle the present obligation at the end of the reporting period, taking into account the risks and uncertainties surrounding the obligation.

A contingent liability is recognised for a possible obligation, for which it is not yet confirmed that a present obligation exists that could lead to an outflow of resources; or for a present obligation that does not meet the definitions of a provision or a liability as it is not probable that an outflow of resources will be required to settle the obligation or when a sufficiently reliable estimate of the amount cannot be made.

Investment in subsidiaries

Investments in subsidiaries are held in the statement of financial position at cost less impairment. settle’s interest has been included in these financial statements as an investment in associated undertaking.