Value for Money

Statement

In this section we set out our approach to value for money across our operations, demonstrating our commitment to provide good quality, efficient services as well as our compliance with the Regulator for Social Housing value for money standard.

Our approach to Value for Money

To maximise our delivery against our purpose, we have four strategic objectives:

- delivering more homes – playing our part in solving the housing crisis through the development of affordable homes across a range of tenures in our locality;

- a well-run social business – ensuring that we maximise our financial capacity whilst continuing to ensure that we remain stable and viable as well as being a partner of choice to our stakeholders;

- delivering good services – being known for good customer service and the ability to deliver solutions; using data insight together with customer and colleague feedback; and

- being a place where colleagues love to work – to be the ‘go to’ place to work in our geographic area.

In recent years, our approach to value for money has been about how we effectively plan, manage and operate our business so that we maximise our resources in pursuing our purpose. It enables us to understand our core business costs whilst making sure any future activity or undertaking by settle is considered with a focus on value for money outcomes. Our risk assurance framework enables us to manage the risks we take as effectively as possible.

We also embed value for money through key strands of activity across the business:

(a) Good Governance

We operate a clear scheme of delegation within our financial regulations and operating rules and have a clear approach for reporting financial decisions to our boards. The Audit and Risk Committee is responsible for in-depth examination of risk management and reviewing internal and external audit findings.

(b) Financial Management

Robust financial management arrangements are embedded within our operating rules and financial regulations. These include approved levels of financial delegation, our budget setting and variation processes and procurement limits. Annually, capital and revenue budgets are developed by the Executive Team and submitted to Board for approval. Budgets are set in line with the Group’s 30-year business plan to ensure we deliver our objectives whilst meeting loan covenants and our treasury management ‘golden rules’.

These golden rules set out that key investment decisions, for example, new developments and capital projects, must be supported by a financial appraisal which details the return expected on investment. All budgets are monitored by the budget holder with variations from profiled expenditure scrutinised as well as any changes to projected out-turn. Quarterly reforecasts of the budget position are undertaken and reported to Board.

(c) Effective Procurement

Our financial regulations outline the framework for achieving value for money when procuring goods and services, for example, tendering, e-procurement and assessment criteria including social value and environmental sustainability gains. A cross-organisational Procurement Panel is in place to ensure that procurement is undertaken appropriately.

(d) Asset Management

We operate an asset performance model to effectively manage our asset base at settle, which takes into account a series of cost and performance data around our stock. Reviews are undertaken to address under-performing stock. Options would include reinvestment, change of tenure type or disposal. Any decisions are discussed at colleague-led groups before they are formally approved at Executive Team or Board depending on the scale of the proposal.

(e) Customer insights and experience to drive good outcomes

We believe that a value for money customer experience is one that commands high trust with minimal effort to access the services we provide. We are committed to listening to our customers’ views and designing and improving services as a result. Our internal culture of continuous improvement ensures colleagues understand that the views of customers are integral to how we drive improvements in outcomes.

(f) Performance Management Our Annual Delivery Plan outlines what actions are in place during the year to help meet our strategic objectives. Performance against objectives is monitored through key performance indicators presented to each Board meeting quarterly. The key performance indicators are a balance of cost and outcome measures so that there is a comprehensive oversight of the economy, efficiency and effectiveness of services.

(g) Risk Management

A Risk Assurance Framework is in place that helps Board and senior management to identify the key risks facing the budget and the mitigations in place to reduce the scale of risk.

Effective risk management requires clarity in the key controls in place to mitigate the risk and the assurances that are being used to provide satisfaction that the control environment is effective. A fundamental aspect of good risk management is ensuring that we have a strong internal control environment in place. Key controls include ensuring clear policies and procedures are in place, effective training is provided for colleagues to undertake their role and timely and accurate reporting is presented to senior leaders and Board. We gain assurance through a series of management and independent arrangements. Independent assurance is gained through a risk based Internal Audit programme as well as the use of specialist third parties where appropriate.

We conduct a regular review of our customer complaints and perform quarterly root cause analysis that is shared with our service leads. In understanding why things go wrong we can address the issues, minimise the risk of repeat and improve the services we provide.

(h) Developing our People

We have continued to develop our people and reward strategy to ensure settle is able to attract, recruit, develop and retain the right mix of talent, experience and competence to deliver our purpose and the experience we want our customers to have of settle.

To deliver value for money is an integral part of our corporate ethos and values. To do this we need to ensure that everybody at settle has the understanding and opportunity to make this a reality through our learning and development framework.

This approach has underpinned a cycle of service provision reviews to ascertain whether the appropriate balance of effectiveness, economy and efficiency is being achieved.

During the year we have achieved a cost saving of £150k pa, and enhanced the security, resilience and performance of our network, by migrating our infrastructure to the Microsoft Azure cloud. We have been able to reinvest some of this saving into upskilling our IT team to deliver additional value for settle.

We have also been improving processes through innovation and have been able to save colleague time through the introduction of an automated solution for invoice processing, and Universal Credit benefit checking, as well as delivering multiple PowerApps and Power Automate workflows.

Measuring Performance

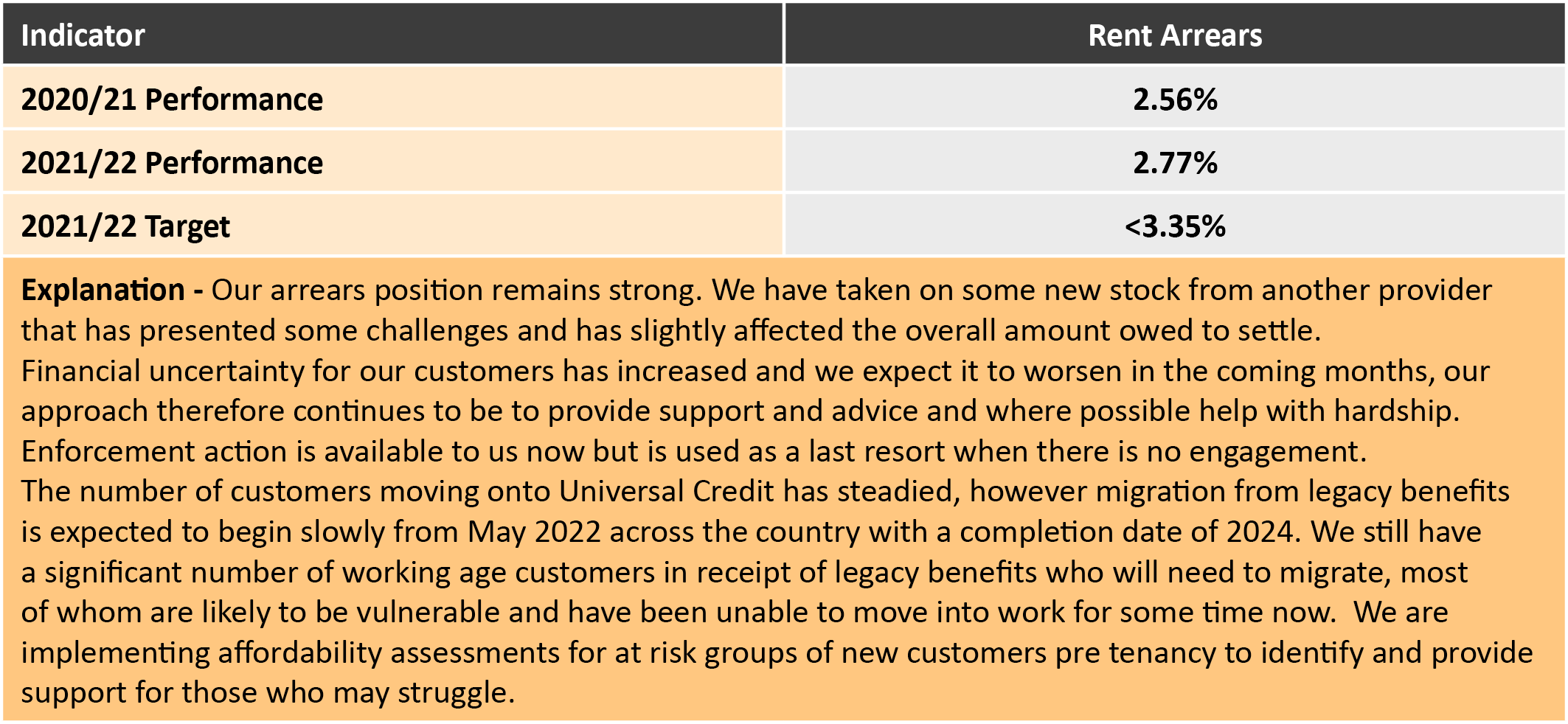

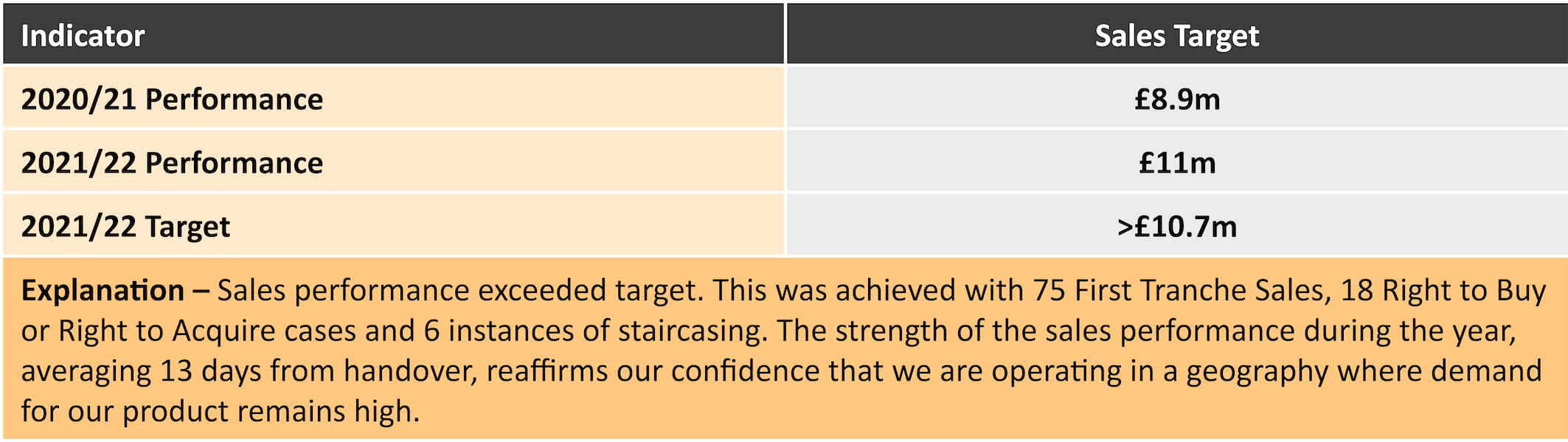

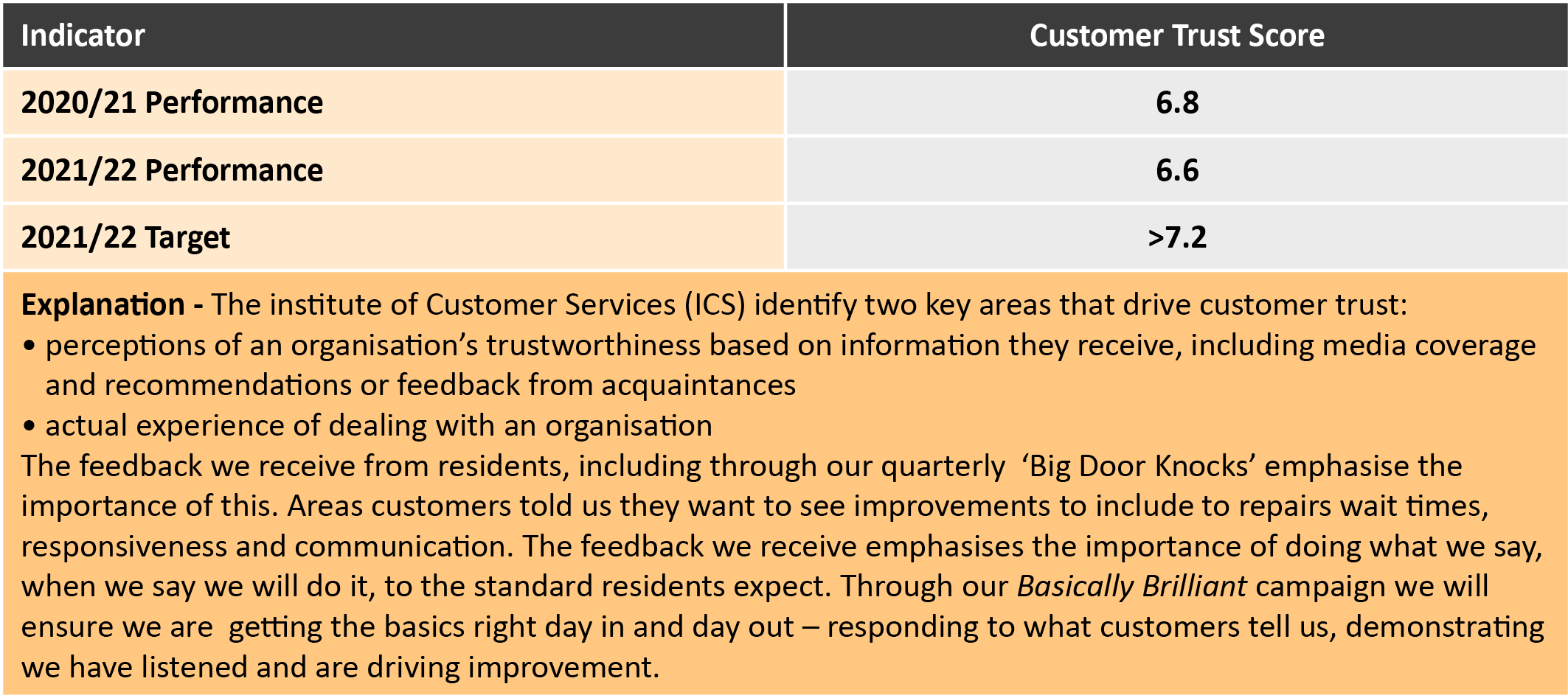

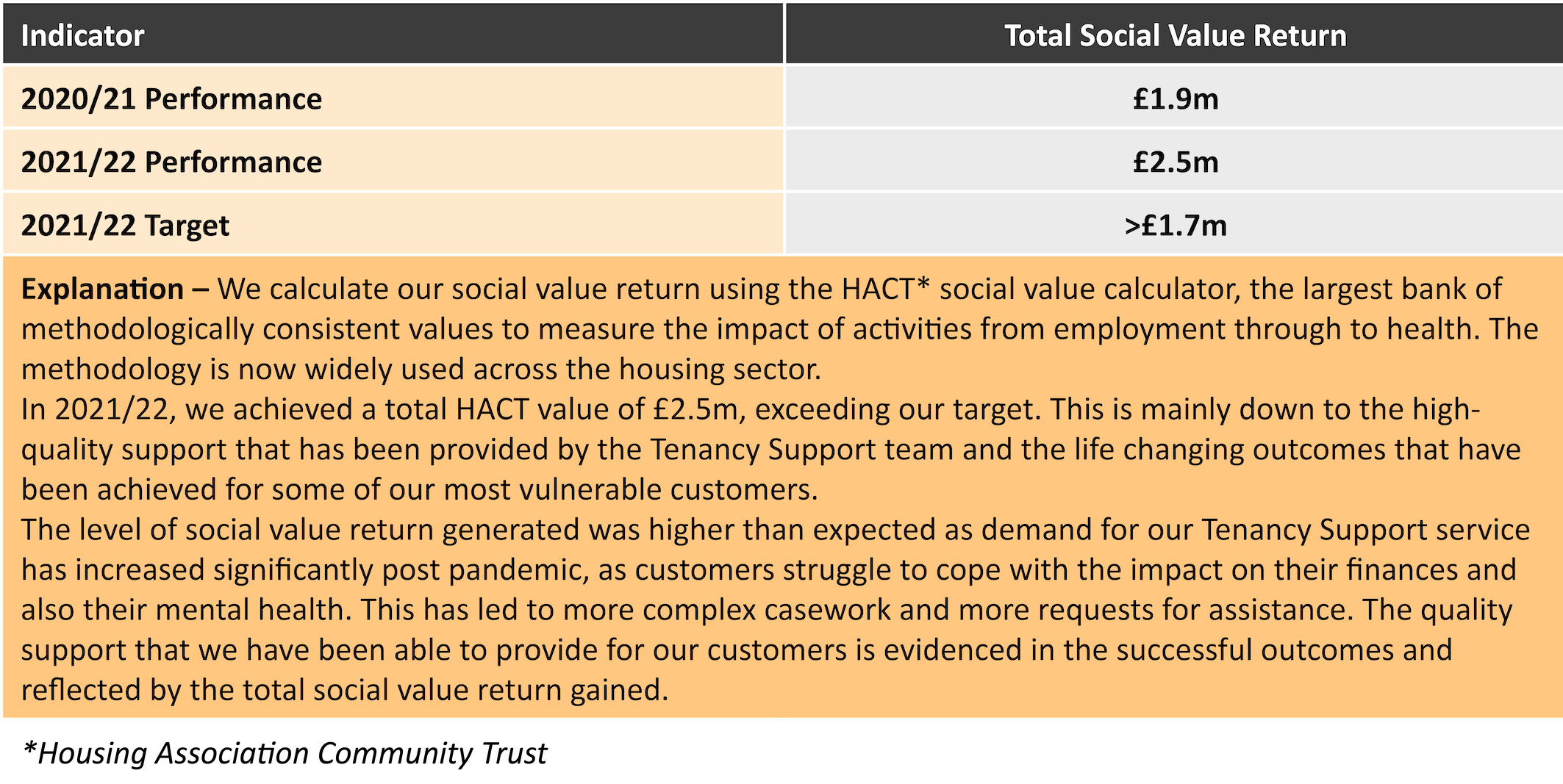

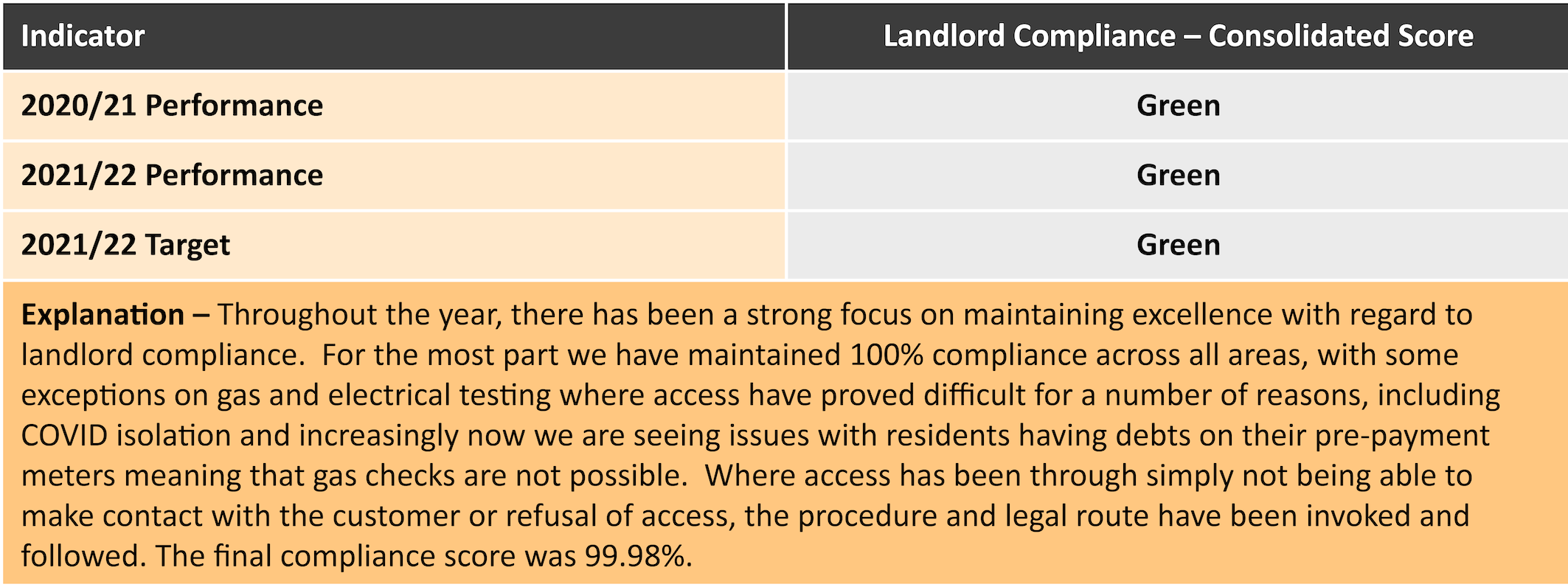

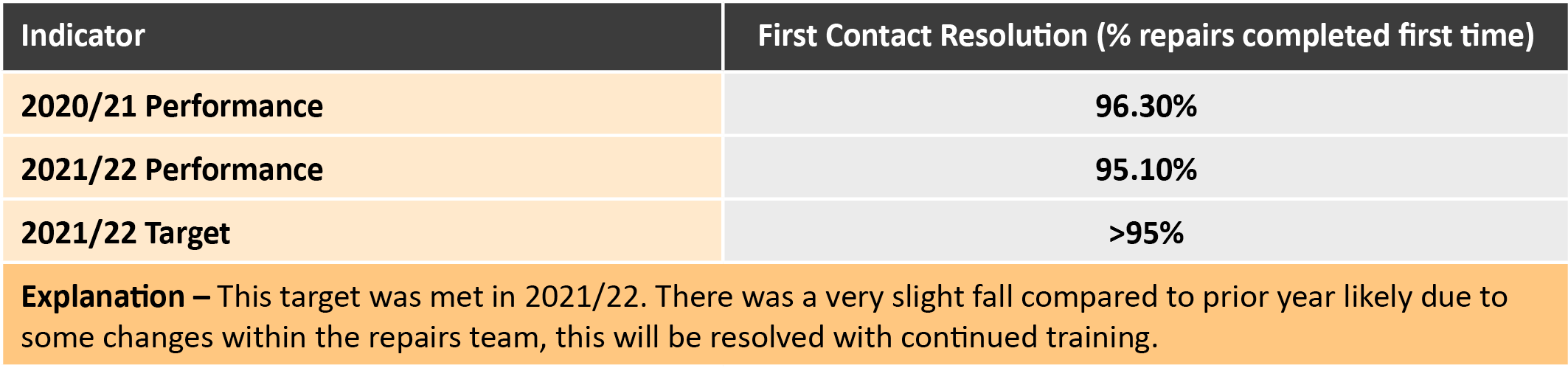

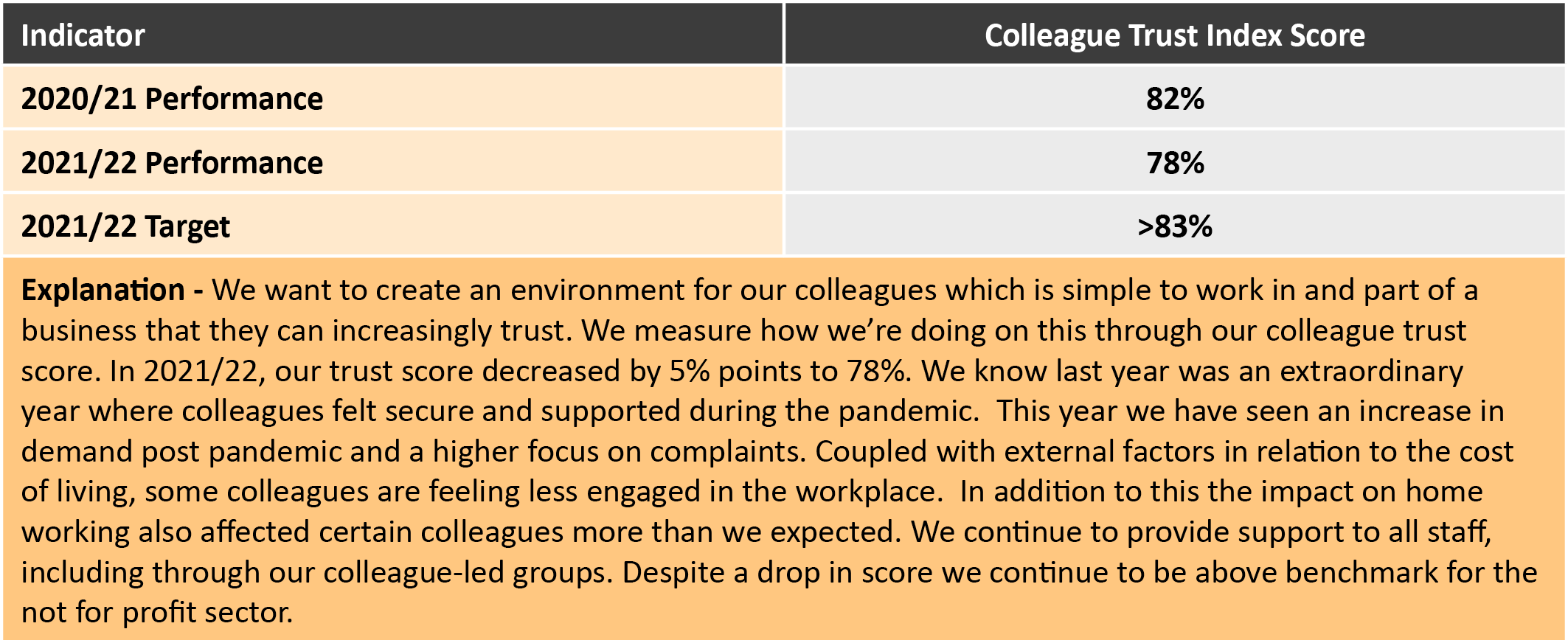

During 2021/22, we have measured our performance through a suite of performance indicators that, along with a set of targets, have been approved by Board. The indicators have been selected as they are considered to be the lead indicators of delivery against our four strategic objectives and performance against them is reported back to Board at each meeting.

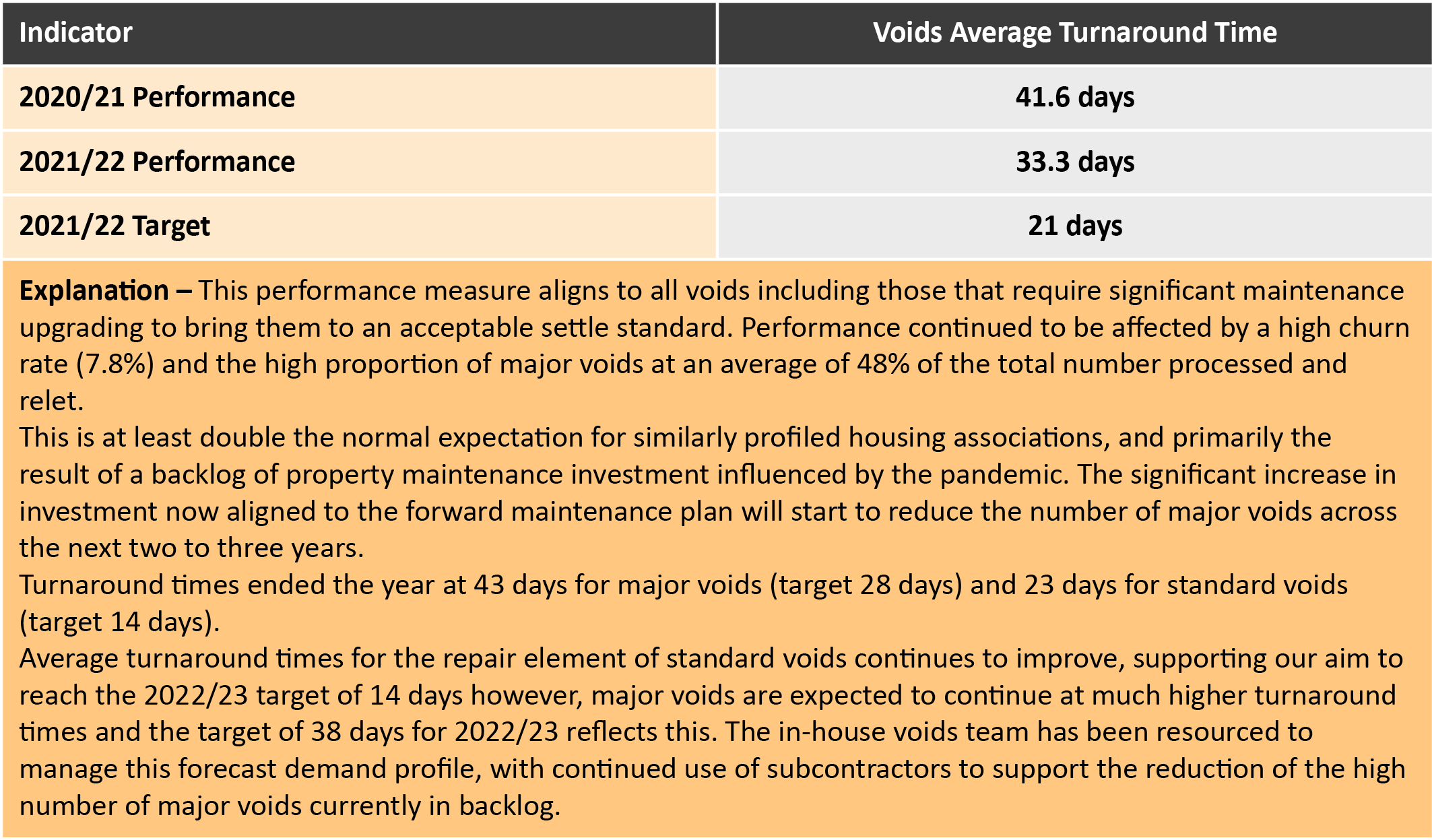

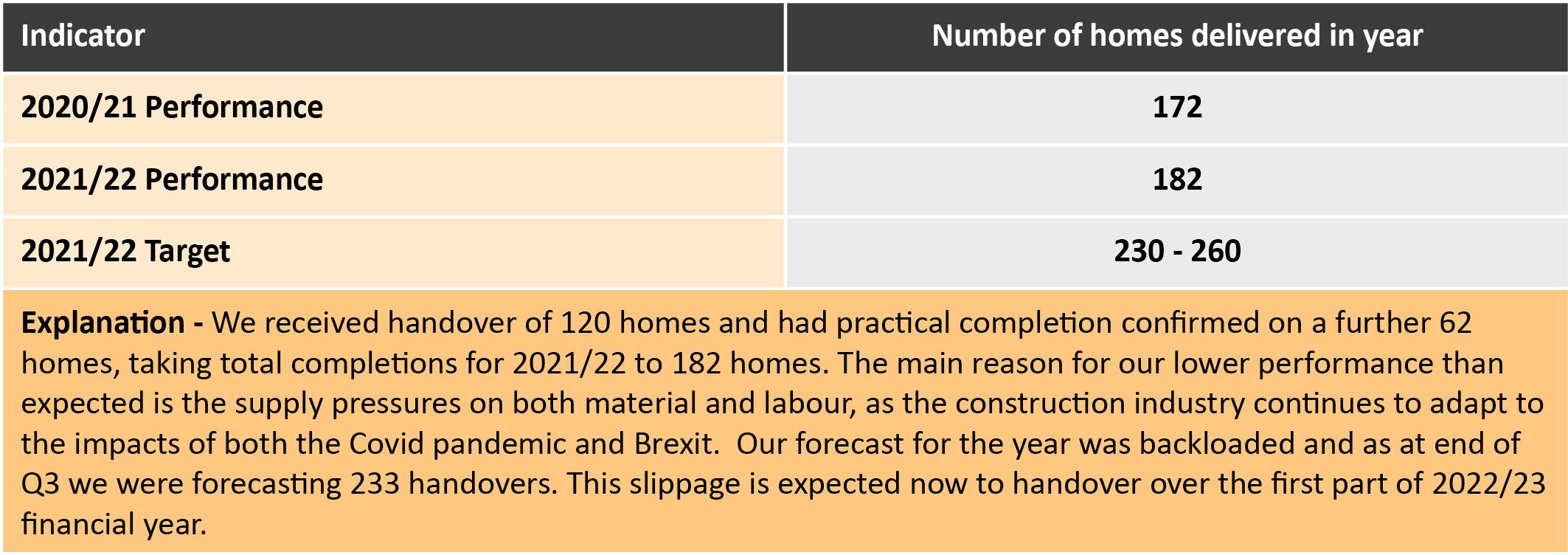

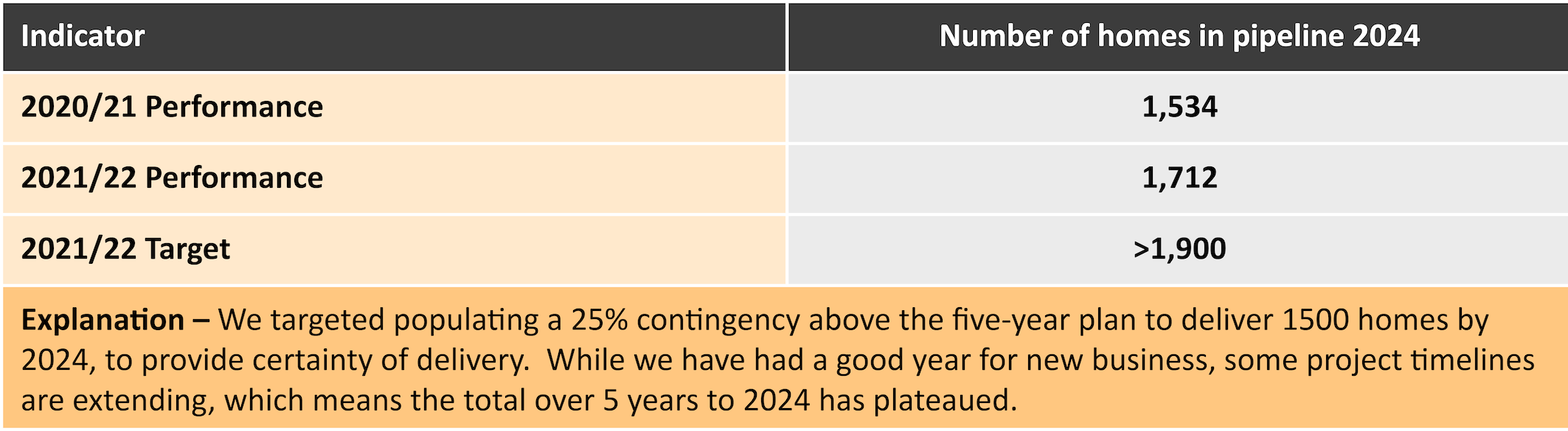

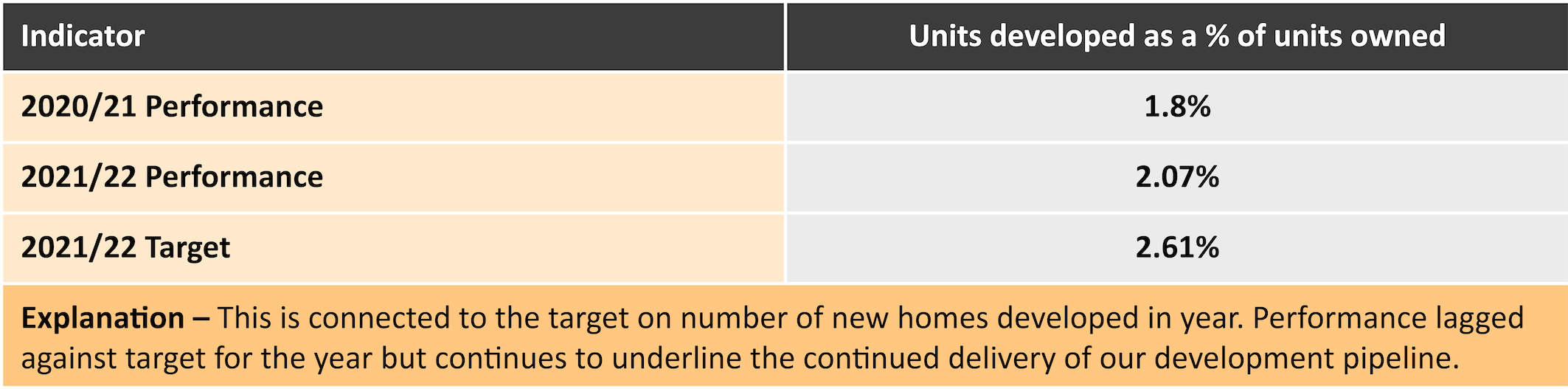

A summary of the 2021/22 performance is in the tables below:

More detail on each measure is shown in the following tables.

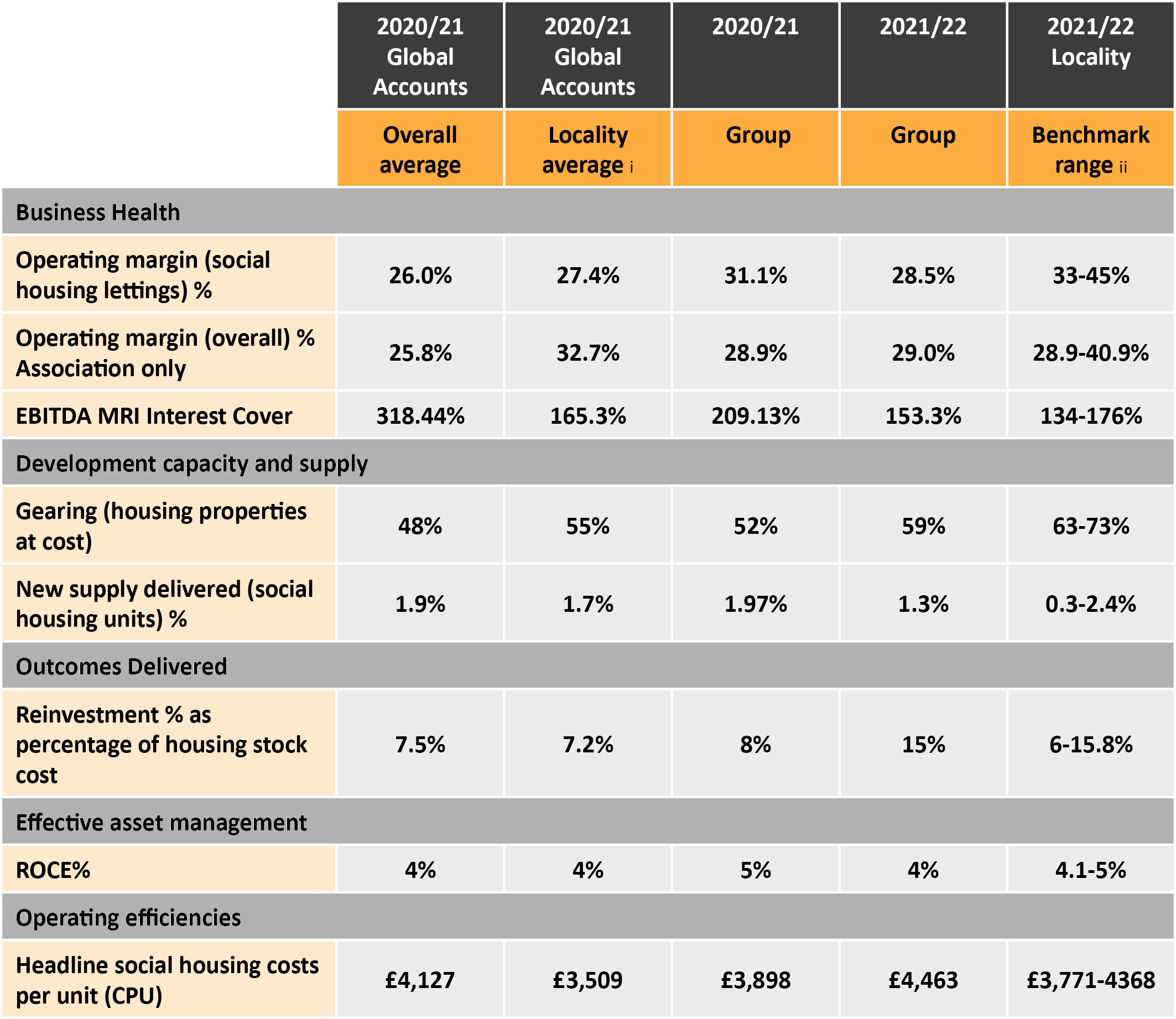

2021/22 Sector Scorecard metrics

We monitor our performance at settle against the Sector Scorecard both in terms of our year-on-year performance and in comparison to other housing associations working in the locality.

The Regulator of Social Housing produces an annual Global Accounts providing financial information for individual providers and an overview of the social housing sector.

Performance is highlighted in the table below:

i This is the Global Accounts benchmark average for similar housing associations in our locality (defined as LSVT housing associations operating primarily in Hertfordshire and/or Bedfordshire). Housing associations used are settle Group, B3 Living, BPHA, Hightown Housing Association, Thrive Homes and Watford Community Action Trust.

ii This is the benchmark average for similar housing associations in our locality (defined as LSVT Housing Associations operating primarily in Hertfordshire and/or Bedfordshire). Housing associations used are, B3 Living, Thrive Homes and BPHA based on 2021/22 unaudited financial statements.

Key Performance Indicators:

Business health

Our operating margin overall has remained broadly in line with the previous year’s performance. Our Social Housing Lettings Margin has reduced with additional expenditure during the year on maintenance of properties.

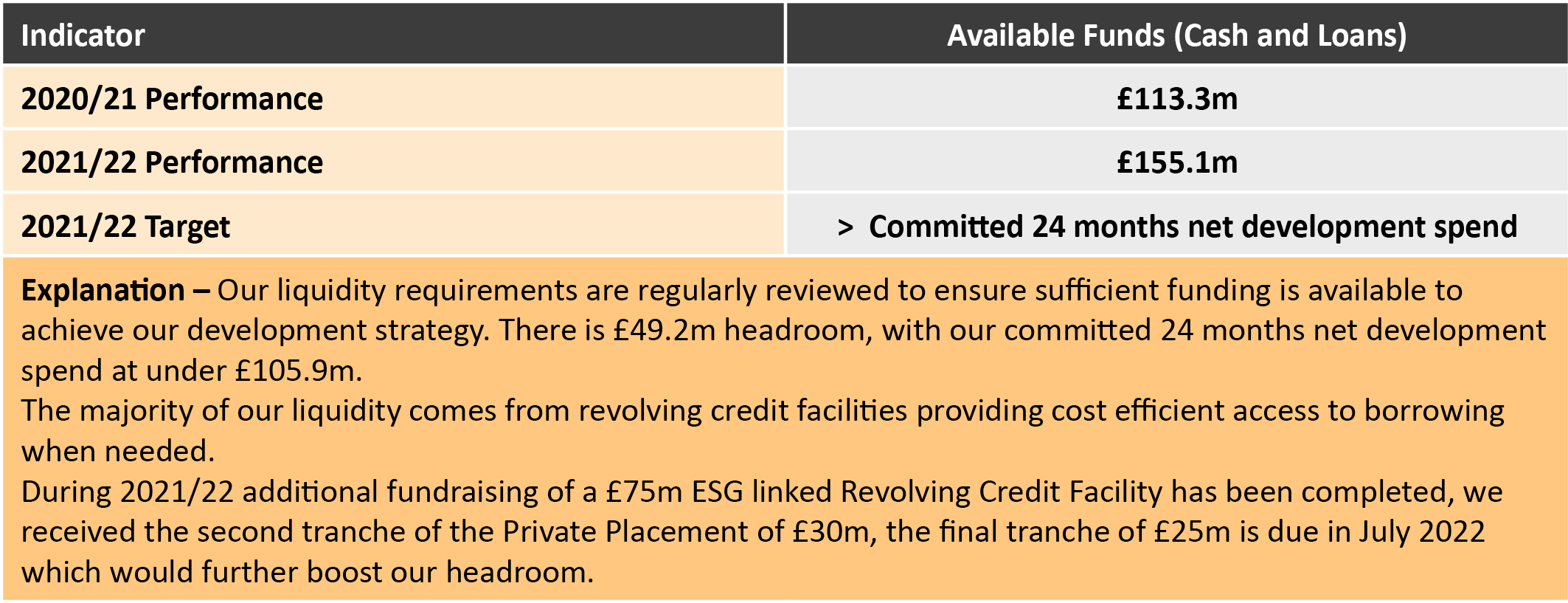

Our long-term financial plan shows that settle continues to operate with reasonable headroom above covenant levels. This has been backed up by the review of our private credit rating from S&P undertaken during 2021/22.

Development capacity and supply

Our gearing has increased slightly but remains well below covenant levels. This puts us in a good position from which to deliver our development strategy and is well within our covenant level. Our corporate plan sets out to deliver 1,500 homes by 2024 of which at least 90% are to be of affordable tenure. We ended the financial year 2021/22 having completed 30% of these homes, with a further 55% already committed to construction.

Outcomes delivered

Investment in our homes has increased in 2021/22. This will continue to rise as we maintain conscious investment in ensuring our homes are safe and environmentally friendly.

Effective asset management: ROCE

Our ROCE remains strong, emphasising the robust economic fundamentals of our operations.

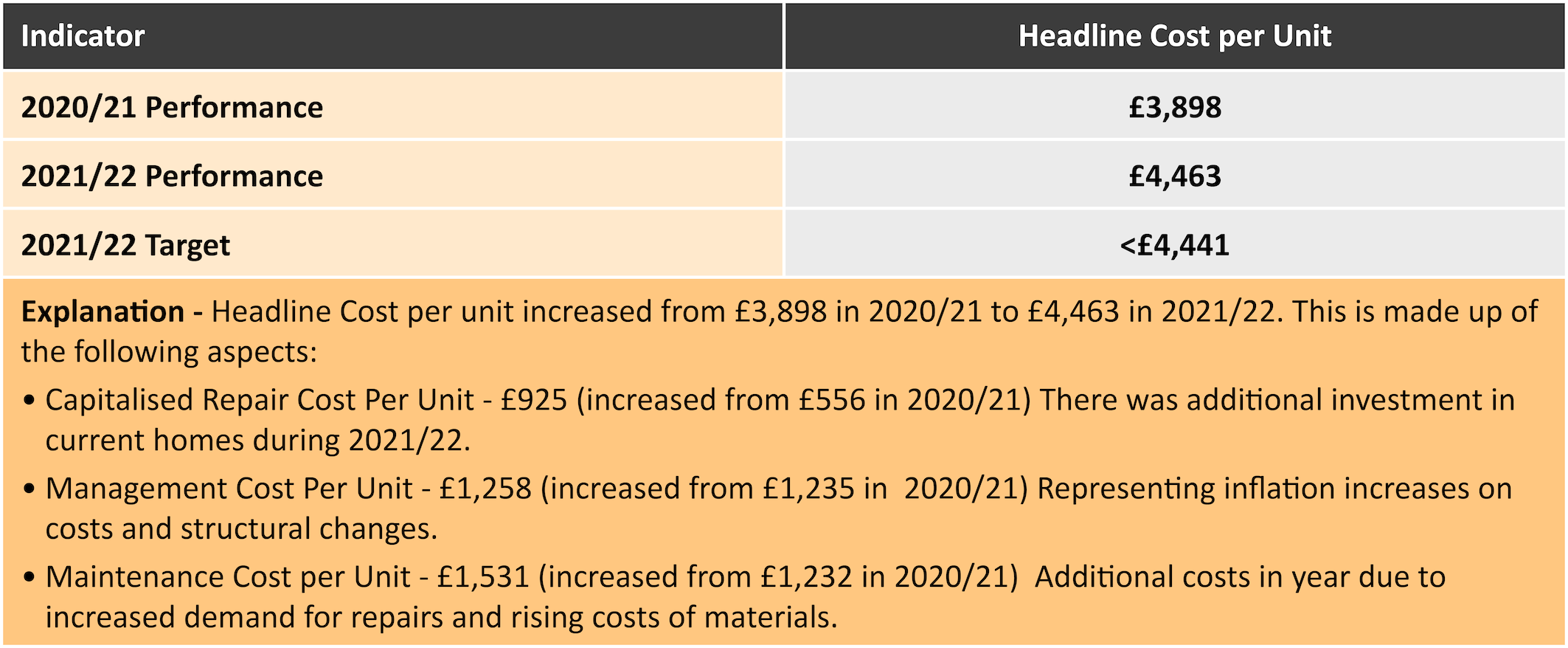

Operating efficiencies: Cost per unit

Our cost per unit has increased during 2021/22 and this was predominantly driven by increased maintenance and capital cost per unit. We continue to look for efficiencies while maintaining performance. It is likely that capital maintenance cost per unit will rise during 2021/22 as we consciously continue to invest in assets, and this will see an overall increase in our cost per unit figures.

Next steps

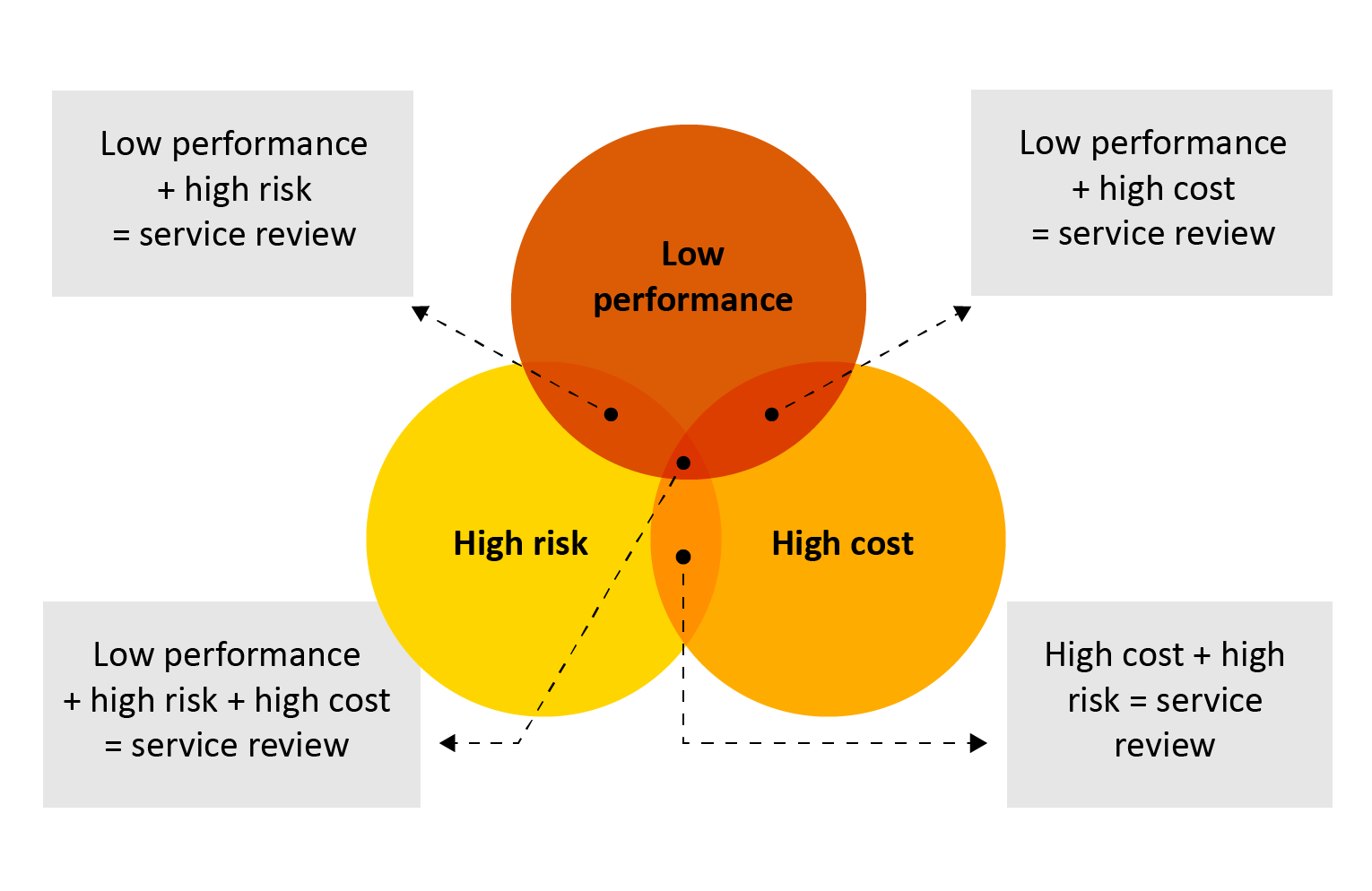

Our approach to Value for Money has remained the same throughout 2021/22. This is best demonstrated by the diagram below:

The Board receives cost per unit effectiveness measures within the management accounts report at each board meeting. Board also receives an additional deep dive into the value for money provision of services to identify what service reviews should be undertaken.

Through this cost analysis, coupled with our performance data and risk appetite statement, we will identify areas of service provision that we will review to ascertain how improvements to value for money can be made – this will continue to include identifying whether settle should be providing the service.

Customer Engagement

Over the past 12 months, we have prioritised being Basically Brilliant – in direct response to customer feedback. This approach demonstrates our commitment first and foremost to getting the basics right – delivering good quality and accessible services and responding to issues effectively, in a way that unites all colleagues across settle.

Basically brilliant has been embedded into our Annual Delivery Plan this year, forming part of corporate and individual objectives. We want colleagues to continue to connect with its aims in a way that makes it simple to demonstrate where they have been basically brilliant, and in turn, really drive the increase in customer satisfaction that we are pushing for. The areas of focus are that settle colleagues:

- Collaborate across teams to solve problems

- Are smart with data to drive improvements

- Communicate boldly, challenging ourselves to be the best we can be

- Seek quick wins to boost customer and colleague satisfaction

- Trust and support front line colleagues to resolve customer concerns first.

The development of our Neighbourhood Plans has provided an opportunity for us to take a more strategic and holistic approach to how we work in our neighbourhoods and enhance our role as a place-based organisation. The focus has been on developing the first plan for the Westmill neighbourhood, which was launched at a public event with residents and community partners in June 2022. settle colleagues engaged in this phase of the research collectively recognised that the development of the first plan has been challenging, with a lot of lessons learnt about the process and the steps required to create and embed a neighbourhood plan.

We have always been focused on the resilience of residents through our tenancy support team at settle. Working with residents we were proud to relaunch the support we provide as settle plus in June 2021, retaining the focus on identifying the support needed by any customer who is either vulnerable or experiencing reduced resilience. To ensure we are Basically Brilliant in our approach to settle plus the referral process is simple – with the neighbourhood or older people’s services housing officer taking the lead on the case and providing support/signposting to the customer.